EX-99.2

Published on May 4, 2021

Q1 2021 INVESTOR PRESENTATION May 5, 2021

2 FORWARD LOOKING STATEMENTS Except for historical information contained herein, the statements and information in this presentation, including the oral statements made in connection herewith, are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “may,” “could,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” and other expressions that are predictions of, or indicate, future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include, among other matters, statements about our business strategy, industry, future profitability, expected fleet utilization, sustainability efforts, the future performance of newly improved technology (such as our DuraStim® fleets), expected capital expenditures and the impact of such expenditures on our performance and capital programs. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. Although forward-looking statements reflect our good faith beliefs at the time they are made, forward-looking statements are subject to a number of risks and uncertainties that may cause actual events and results to differ materially from the forward-looking statements. Such risks and uncertainties include the volatility of and recent declines in oil prices, the operational disruption and market volatility resulting from the COVID-19 pandemic and other factors described in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, particularly the “Risk Factors” sections of such filings, and other filings with the Securities and Exchange Commission (the “SEC”). In addition, we may be subject to currently unforeseen risks that may have a materially adverse impact on us, including matters related to shareholder litigation and the SEC investigation. Accordingly, no assurances can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements and are urged to carefully review and consider the various disclosures made in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings made with the SEC from time to time that disclose risks and uncertainties that may affect our business. The forward-looking statements in this presentation are made as of the date of this presentation. We do not undertake, and expressly disclaim, any duty to publicly update these statements, whether as a result of new information, new developments or otherwise, except to the extent that disclosure is required by law.

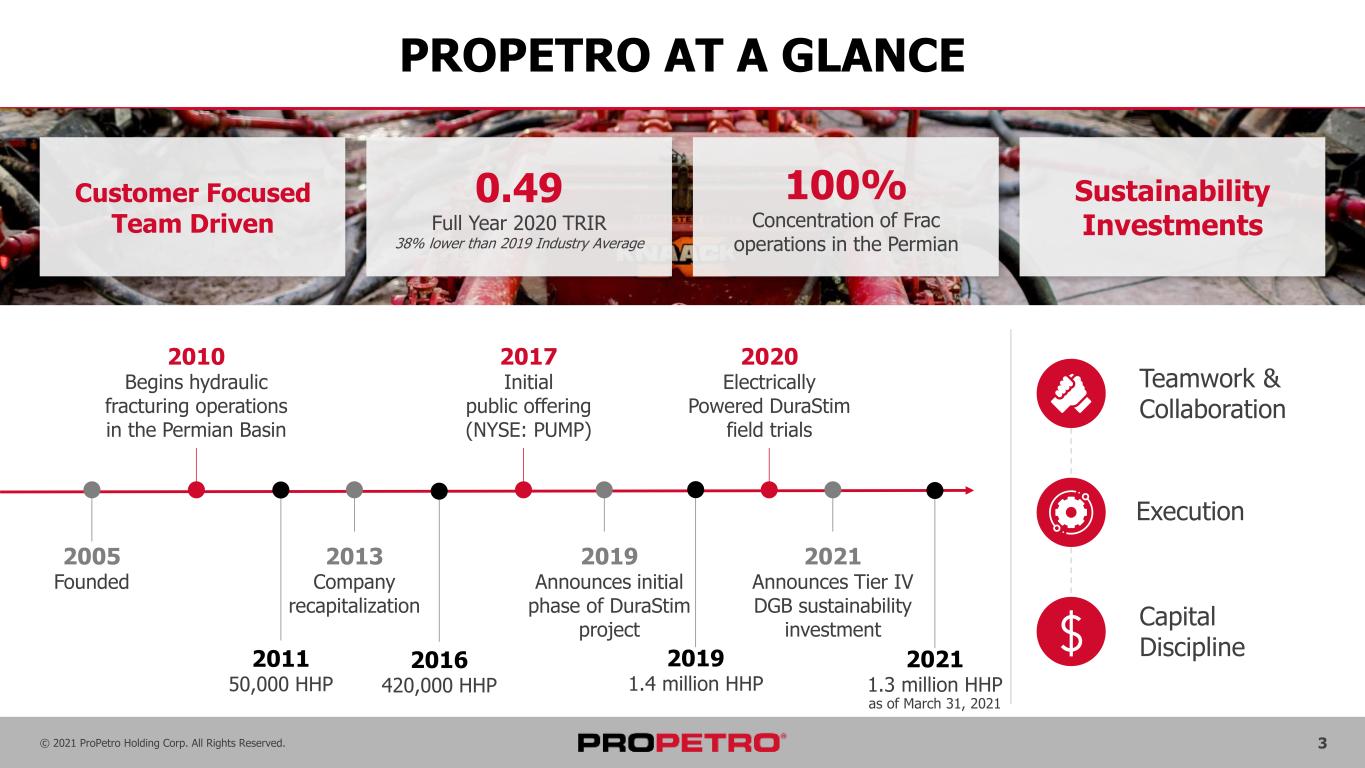

© 2021 ProPetro Holding Corp. All Rights Reserved. 3 PROPETRO AT A GLANCE 2005 Founded 2010 Begins hydraulic fracturing operations in the Permian Basin 2013 Company recapitalization 2017 Initial public offering (NYSE: PUMP) 2019 Announces initial phase of DuraStim project 2020 Electrically Powered DuraStim field trials 2021 Announces Tier IV DGB sustainability investment Teamwork & Collaboration Execution Capital Discipline 0.49 Full Year 2020 TRIR 38% lower than 2019 Industry Average Customer Focused Team Driven Sustainability Investments 100% Concentration of Frac operations in the Permian 2011 50,000 HHP 2016 420,000 HHP 2019 1.4 million HHP 2021 1.3 million HHP as of March 31, 2021

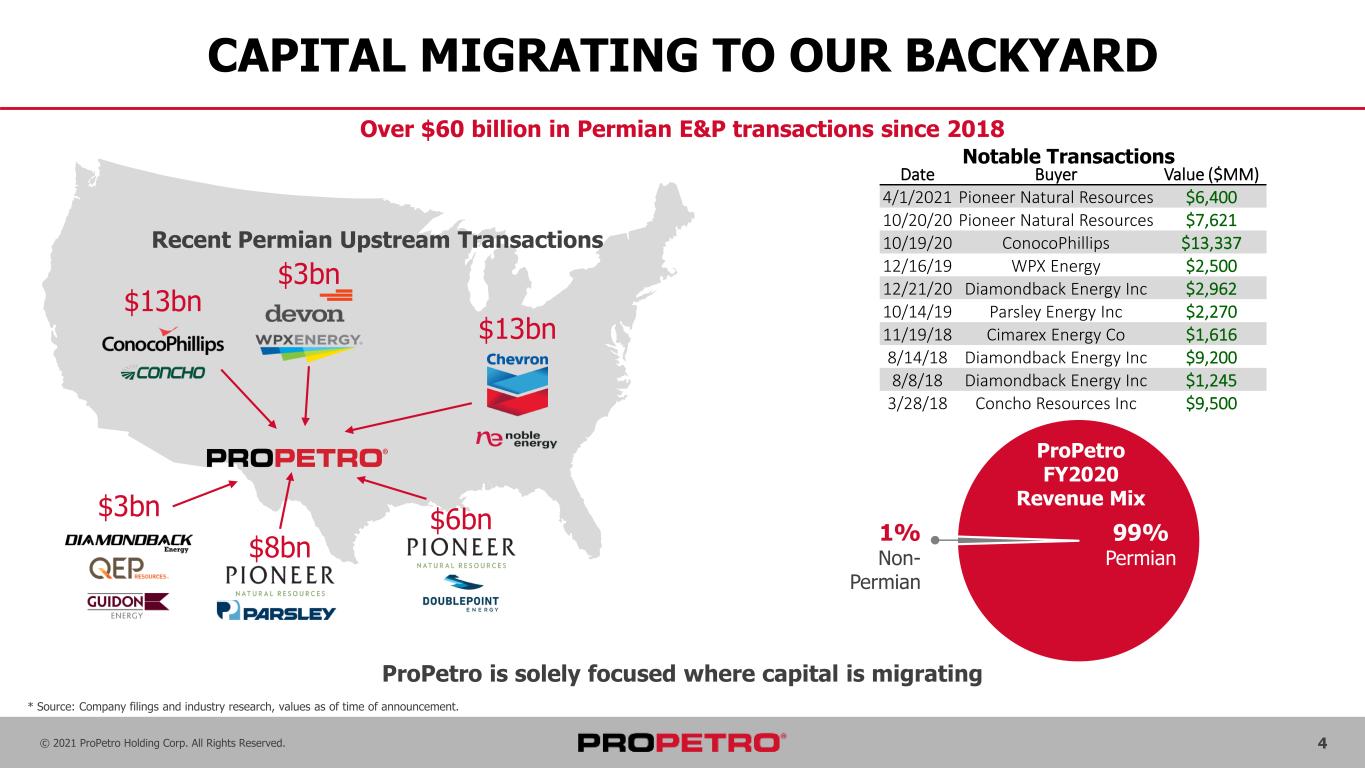

© 2021 ProPetro Holding Corp. All Rights Reserved. 4 ProPetro is solely focused where capital is migrating CAPITAL MIGRATING TO OUR BACKYARD Over $60 billion in Permian E&P transactions since 2018 99% Permian 1% Non- Permian ProPetro FY2020 Revenue Mix $6bn $13bn $3bn $3bn $13bn Date Buyer Value ($MM) 4/1/2021 Pioneer Natural Resources $6,400 10/20/20 Pioneer Natural Resources $7,621 10/19/20 ConocoPhillips $13,337 12/16/19 WPX Energy $2,500 12/21/20 Diamondback Energy Inc $2,962 10/14/19 Parsley Energy Inc $2,270 11/19/18 Cimarex Energy Co $1,616 8/14/18 Diamondback Energy Inc $9,200 8/8/18 Diamondback Energy Inc $1,245 3/28/18 Concho Resources Inc $9,500 Recent Permian Upstream Transactions Notable Transactions * Source: Company filings and industry research, values as of time of announcement. $8bn

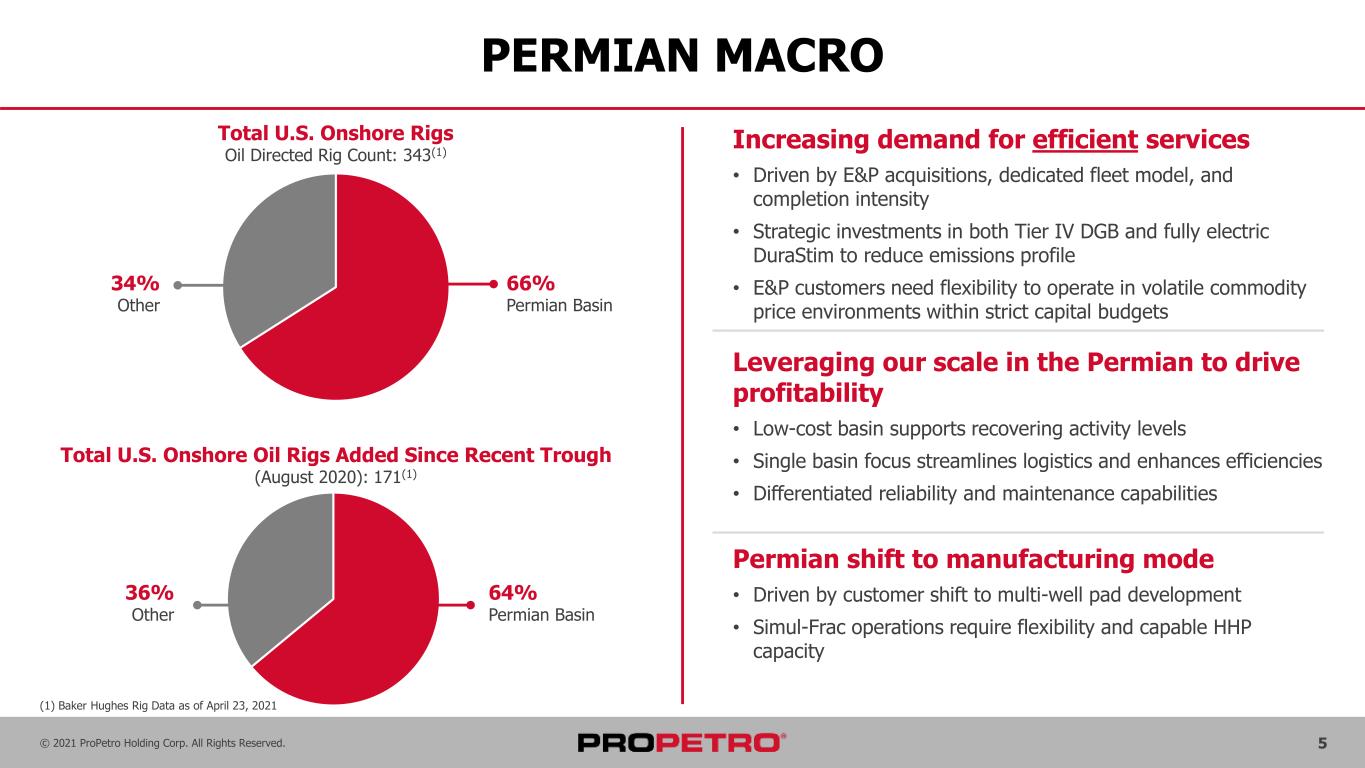

© 2021 ProPetro Holding Corp. All Rights Reserved. 5 Leveraging our scale in the Permian to drive profitability • Low-cost basin supports recovering activity levels • Single basin focus streamlines logistics and enhances efficiencies • Differentiated reliability and maintenance capabilities Increasing demand for efficient services • Driven by E&P acquisitions, dedicated fleet model, and completion intensity • Strategic investments in both Tier IV DGB and fully electric DuraStim to reduce emissions profile • E&P customers need flexibility to operate in volatile commodity price environments within strict capital budgets PERMIAN MACRO Permian shift to manufacturing mode • Driven by customer shift to multi-well pad development • Simul-Frac operations require flexibility and capable HHP capacity (1) Baker Hughes Rig Data as of April 23, 2021 Total U.S. Onshore Rigs Oil Directed Rig Count: 343(1) 66% Permian Basin 34% Other Total U.S. Onshore Oil Rigs Added Since Recent Trough (August 2020): 171(1) 64% Permian Basin 36% Other

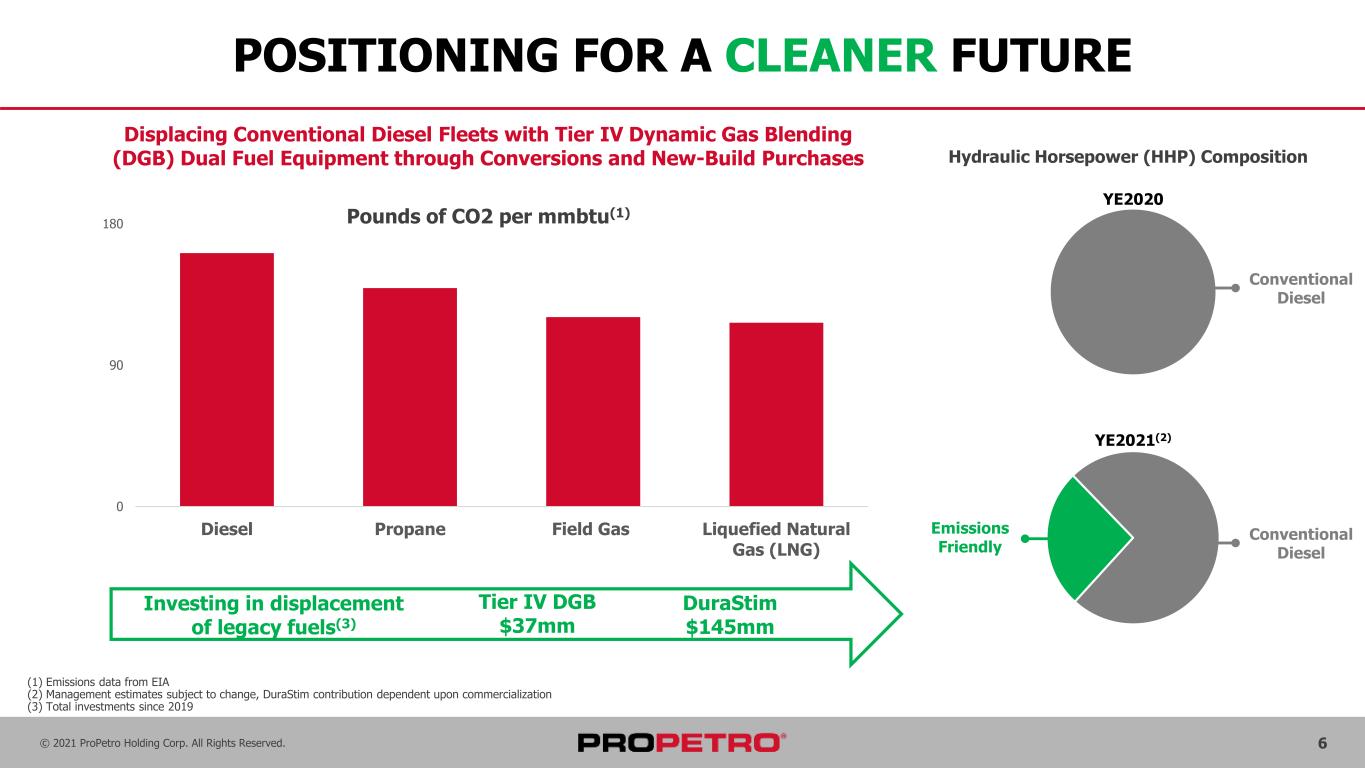

© 2021 ProPetro Holding Corp. All Rights Reserved. 6 0 90 180 Diesel Propane Field Gas Liquefied Natural Gas (LNG) Pounds of CO2 per mmbtu(1) POSITIONING FOR A CLEANER FUTURE Tier II Diesel 100% Hydraulic Horsepower (HHP) Composition YE2020 YE2021(2) (1) Emissions data from EIA (2) Management estimates subject to change, DuraStim contribution dependent upon commercialization (3) Total investments since 2019 DuraStim $145mm Tier IV DGB $37mm Investing in displacement of legacy fuels(3) Emissions Friendly Conventional Diesel Conventional Diesel Displacing Conventional Diesel Fleets with Tier IV Dynamic Gas Blending (DGB) Dual Fuel Equipment through Conversions and New-Build Purchases

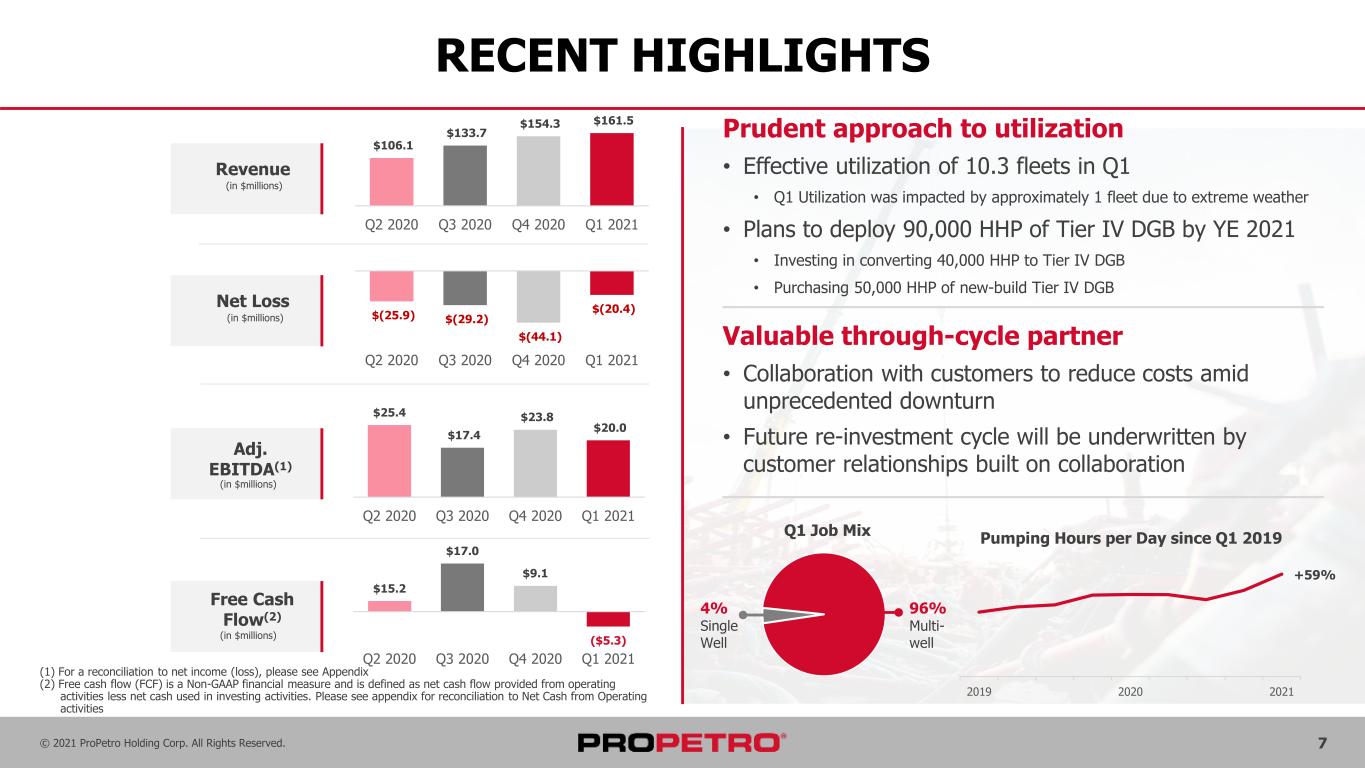

© 2021 ProPetro Holding Corp. All Rights Reserved. 7 RECENT HIGHLIGHTS (1) For a reconciliation to net income (loss), please see Appendix (2) Free cash flow (FCF) is a Non-GAAP financial measure and is defined as net cash flow provided from operating activities less net cash used in investing activities. Please see appendix for reconciliation to Net Cash from Operating activities Prudent approach to utilization • Effective utilization of 10.3 fleets in Q1 • Q1 Utilization was impacted by approximately 1 fleet due to extreme weather • Plans to deploy 90,000 HHP of Tier IV DGB by YE 2021 • Investing in converting 40,000 HHP to Tier IV DGB • Purchasing 50,000 HHP of new-build Tier IV DGB Valuable through-cycle partner • Collaboration with customers to reduce costs amid unprecedented downturn • Future re-investment cycle will be underwritten by customer relationships built on collaboration Revenue Adj. EBITDA(1) Free Cash Flow(2) $106.1 $133.7 $154.3 $161.5 Q2 2020 Q3 2020 Q4 2020 Q1 2021 (in $millions) (in $millions) $25.4 $17.4 $23.8 $20.0 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q1 Job Mix 4% Single Well 96% Multi- well (in $millions) $15.2 $17.0 $9.1 ($5.3) Q2 2020 Q3 2020 Q4 2020 Q1 2021 Net Loss $(25.9) $(29.2) $(44.1) $(20.4) Q2 2020 Q3 2020 Q4 2020 Q1 2021 (in $millions) +59% 2019 2020 2021 Pumping Hours per Day since Q1 2019

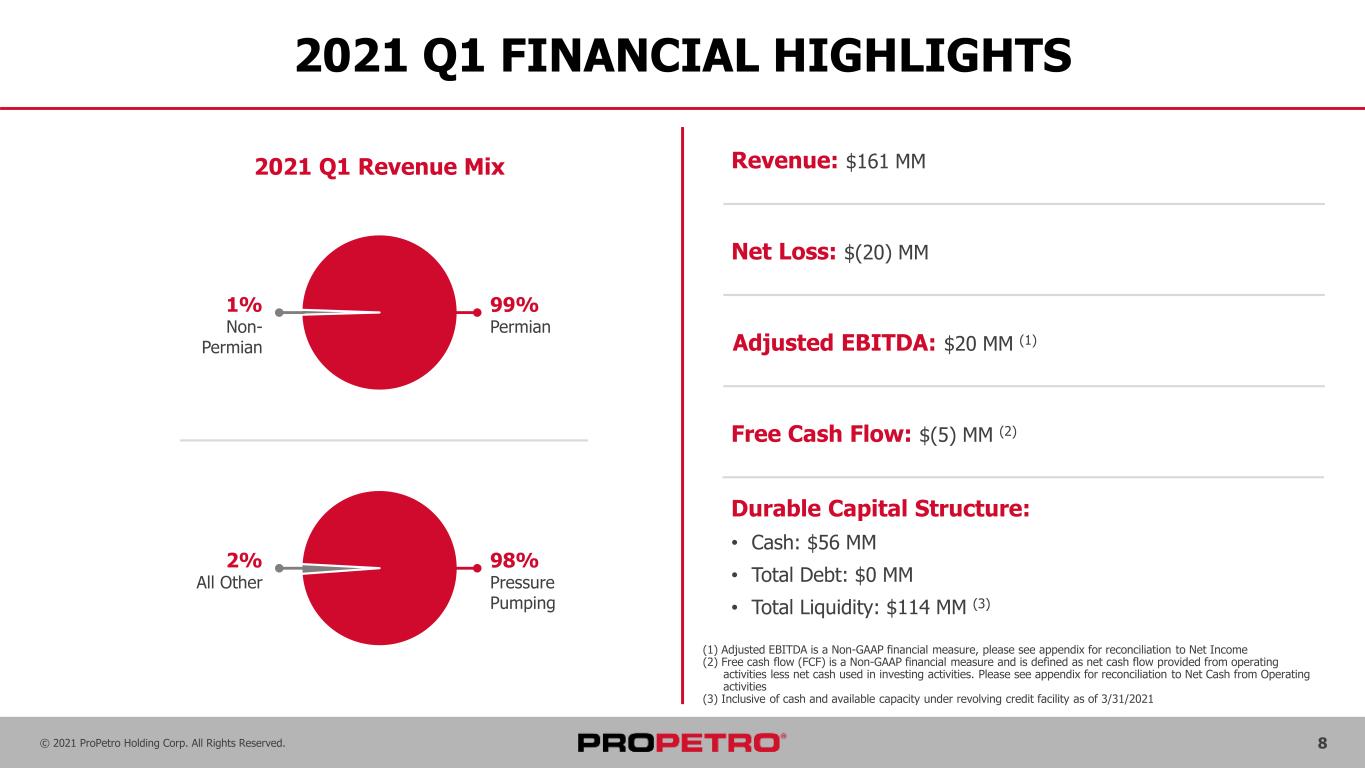

© 2021 ProPetro Holding Corp. All Rights Reserved. 8 Net Loss: $(20) MM 2021 Q1 FINANCIAL HIGHLIGHTS Adjusted EBITDA: $20 MM (1) Free Cash Flow: $(5) MM (2) (1) Adjusted EBITDA is a Non-GAAP financial measure, please see appendix for reconciliation to Net Income (2) Free cash flow (FCF) is a Non-GAAP financial measure and is defined as net cash flow provided from operating activities less net cash used in investing activities. Please see appendix for reconciliation to Net Cash from Operating activities (3) Inclusive of cash and available capacity under revolving credit facility as of 3/31/2021 Durable Capital Structure: • Cash: $56 MM • Total Debt: $0 MM • Total Liquidity: $114 MM (3) 2021 Q1 Revenue Mix 99% Permian 1% Non- Permian 98% Pressure Pumping 2% All Other Revenue: $161 MM

© 2021 ProPetro Holding Corp. All Rights Reserved. 9 UNIQUELY POSITIONED FOR SUCCESS Permian Focus Positioned in the low cost basin with sector leading operating scale Blue Chip Customers Large drilling inventories and sizeable rig programs Superior Performance Consistently outperforming the competition on location and efficient Simul-Frac completions partner Sustainable Future Investing in lower emissions equipment to reduce our carbon footprint Capital Discipline Strong Balance Sheet with no debt; disciplined capital allocation and asset deployment Safety Culture Full year 2020 Total Recordable Incident Rate of 0.49 Access to Premier Projects Meeting customer needs on their most complex jobs; dedicated contract with Pioneer Natural Resources including Simul-Frac Technology Leveraging leading cloud-based solutions to drive well-site performance to pull innovation forward

APPENDIX

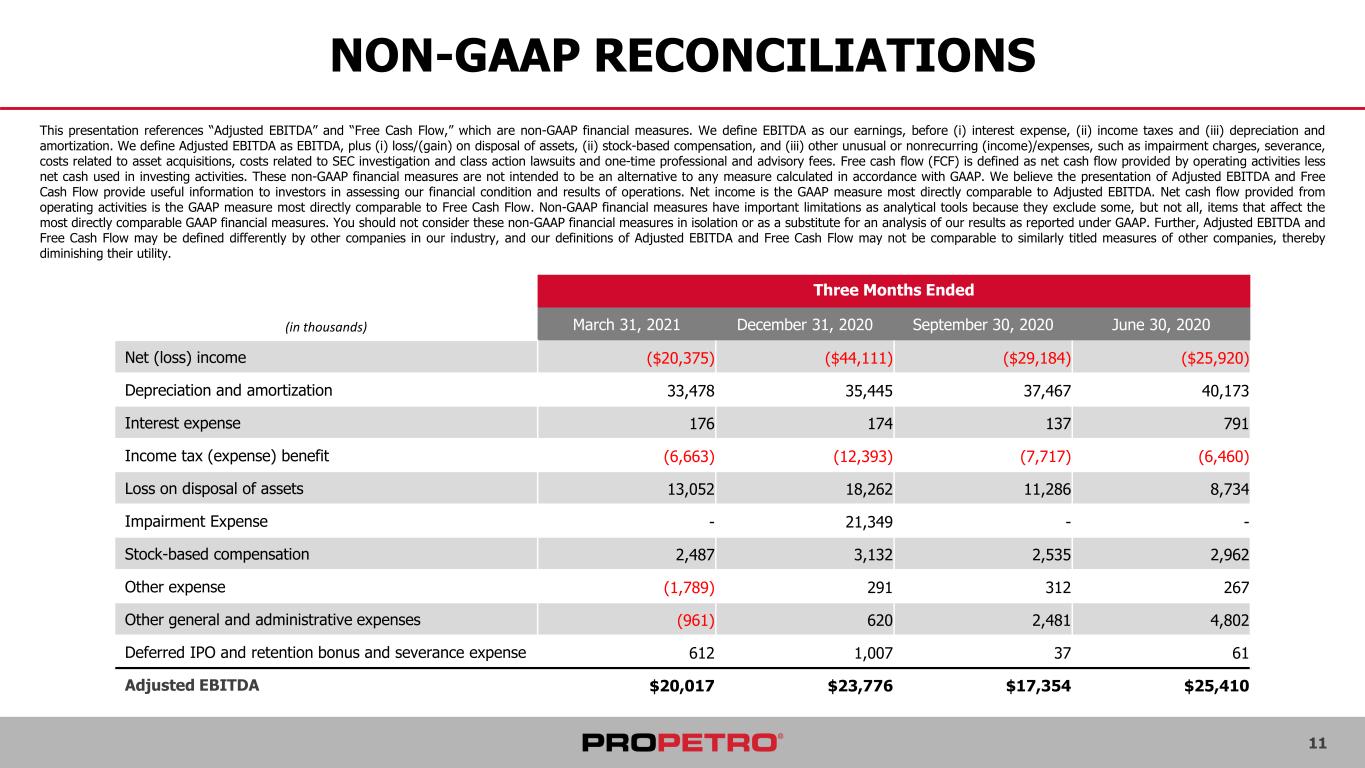

11 NON-GAAP RECONCILIATIONS Three Months Ended (in thousands) March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Net (loss) income ($20,375) ($44,111) ($29,184) ($25,920) Depreciation and amortization 33,478 35,445 37,467 40,173 Interest expense 176 174 137 791 Income tax (expense) benefit (6,663) (12,393) (7,717) (6,460) Loss on disposal of assets 13,052 18,262 11,286 8,734 Impairment Expense - 21,349 - - Stock-based compensation 2,487 3,132 2,535 2,962 Other expense (1,789) 291 312 267 Other general and administrative expenses (961) 620 2,481 4,802 Deferred IPO and retention bonus and severance expense 612 1,007 37 61 Adjusted EBITDA $20,017 $23,776 $17,354 $25,410 This presentation references “Adjusted EBITDA” and “Free Cash Flow,” which are non-GAAP financial measures. We define EBITDA as our earnings, before (i) interest expense, (ii) income taxes and (iii) depreciation and amortization. We define Adjusted EBITDA as EBITDA, plus (i) loss/(gain) on disposal of assets, (ii) stock-based compensation, and (iii) other unusual or nonrecurring (income)/expenses, such as impairment charges, severance, costs related to asset acquisitions, costs related to SEC investigation and class action lawsuits and one-time professional and advisory fees. Free cash flow (FCF) is defined as net cash flow provided by operating activities less net cash used in investing activities. These non-GAAP financial measures are not intended to be an alternative to any measure calculated in accordance with GAAP. We believe the presentation of Adjusted EBITDA and Free Cash Flow provide useful information to investors in assessing our financial condition and results of operations. Net income is the GAAP measure most directly comparable to Adjusted EBITDA. Net cash flow provided from operating activities is the GAAP measure most directly comparable to Free Cash Flow. Non-GAAP financial measures have important limitations as analytical tools because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider these non-GAAP financial measures in isolation or as a substitute for an analysis of our results as reported under GAAP. Further, Adjusted EBITDA and Free Cash Flow may be defined differently by other companies in our industry, and our definitions of Adjusted EBITDA and Free Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

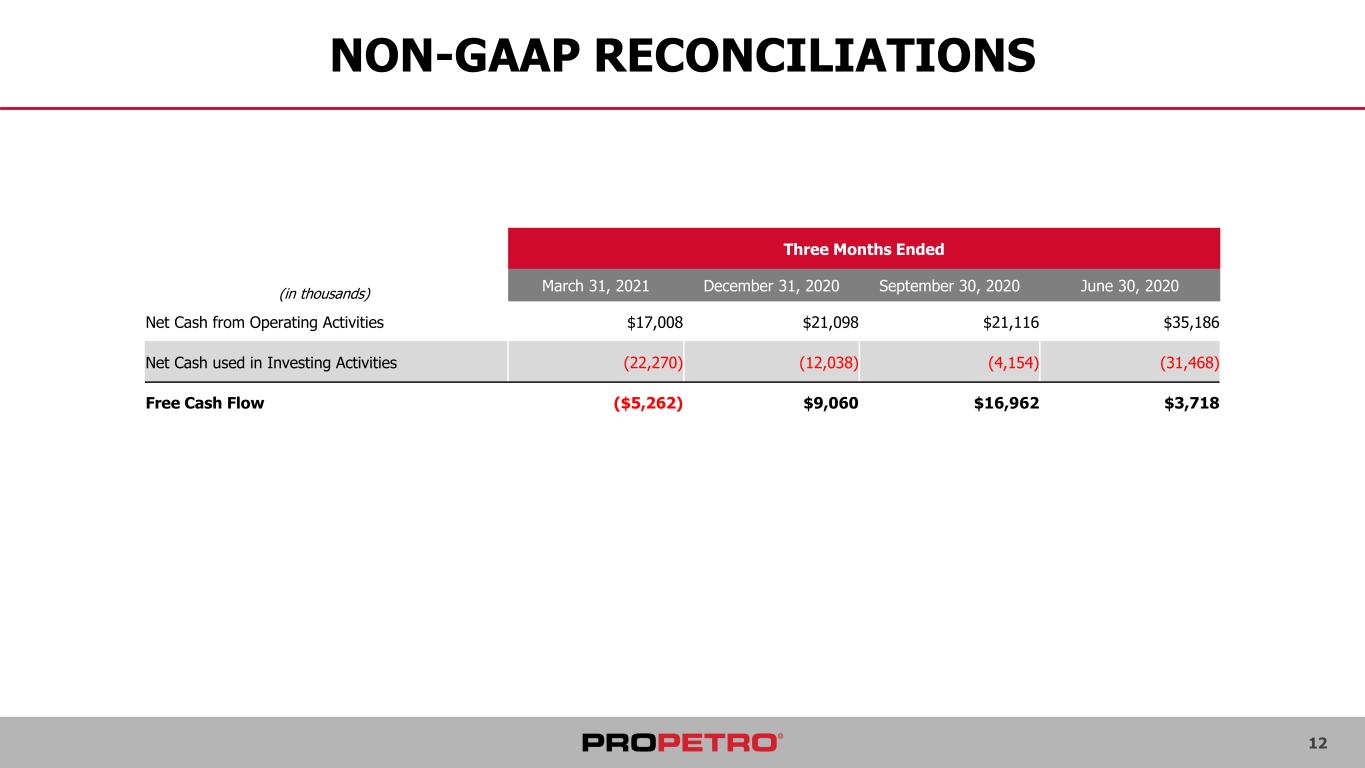

12 NON-GAAP RECONCILIATIONS Three Months Ended (in thousands) March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Net Cash from Operating Activities $17,008 $21,098 $21,116 $35,186 Net Cash used in Investing Activities (22,270) (12,038) (4,154) (31,468) Free Cash Flow ($5,262) $9,060 $16,962 $3,718

© 2021 ProPetro Holding Corp. All Rights Reserved. 13 CONTACT www.propetroservices.com Corporate Headquarters Investor Relations 1706 S. Midkiff Rd Midland, TX 79701 432.688.0012 David Schorlemer - CFO investors@propetroservices.com Office 432.688.0012