EX-99.1

Published on August 2, 2023

EXHIBIT 99.1 ProPetro Reports Financial Results for the Second Quarter of 2023 MIDLAND, Texas, August 2, 2023, (Business Wire) – ProPetro Holding Corp. ("ProPetro" or "the Company") (NYSE: PUMP) today announced financial and operational results for the second quarter of 2023. Second Quarter 2023 Results and Highlights • Total revenue increased 3% sequentially to $435 million compared to the prior quarter. • Highest quarterly net income in over four years of $39 million, or $0.34 per diluted share. • Adjusted EBITDA(1) for the quarter decreased 5% sequentially to $113 million or 26% of revenue. • Net cash provided by operating activities of approximately $114 million. • Free Cash Flow(2) was approximately $6 million. • Effective frac fleet utilization increased to 15.9 fleets compared to 15.5 fleets in the prior quarter. • Repurchased 2.3 million shares during the quarter, representing 2% of outstanding shares, for $17.5 million at a 27% discount to the share price as of July 31, 2023. (1) Adjusted EBITDA is a Non-GAAP financial measure and is described and reconciled to net income (loss) in the table under “Non-GAAP Financial Measures”. (2) Free Cash Flow is a Non-GAAP financial measure and is described and reconciled to cash from operating activities in the table under “Non-GAAP Financial Measures." Management Comments Sam Sledge, Chief Executive Officer, commented, “Building on the year's momentum and the dedication of the ProPetro team, we are pleased to report solid results for the second quarter. All of our service lines exhibited strong performance, particularly wireline and cementing that both had record performance, contributing to our highest quarterly net income in over four years. We're also making significant headway in our fleet modernization, a strategic priority, with the recent addition of our seventh Tier IV DGB dual-fuel hydraulic fracturing fleet. These next generation fleets are highly valued by our customers, as they not only reduce completion costs but also reduce GHG emissions by offering industry-leading diesel displacement. I’d also like to note that toward the end of the second quarter, we voluntarily opted to idle one of our frac fleets that was experiencing pricing pressure that could have put us below our financial return threshold. This should serve as an example that we are dedicated to a margin over market share asset deployment strategy." Mr. Sledge continued, "During the quarter, our strategic initiatives continued to create momentum, notably with the successful performance of our newly acquired wireline business, Silvertip, acquired in November 2022, which substantially enhanced our earnings and cash flow. Further, the approval of our $100 million share repurchase program by the Board in May underscored this period of positive developments and confidence in our strategy. We are proud of these accomplishments that stem from our continued focus on capital discipline and superior field performance across all of our service lines with more opportunities ahead. In the third and fourth quarter, we plan to begin our new FORCESM Electric Frac Fleet deployments with two additional fleets expected to be deployed in the first half of 2024. The seven Tier IV dual-fuel fleets and four FORCESM electric fleets will represent a tremendous transformation to next generation technology

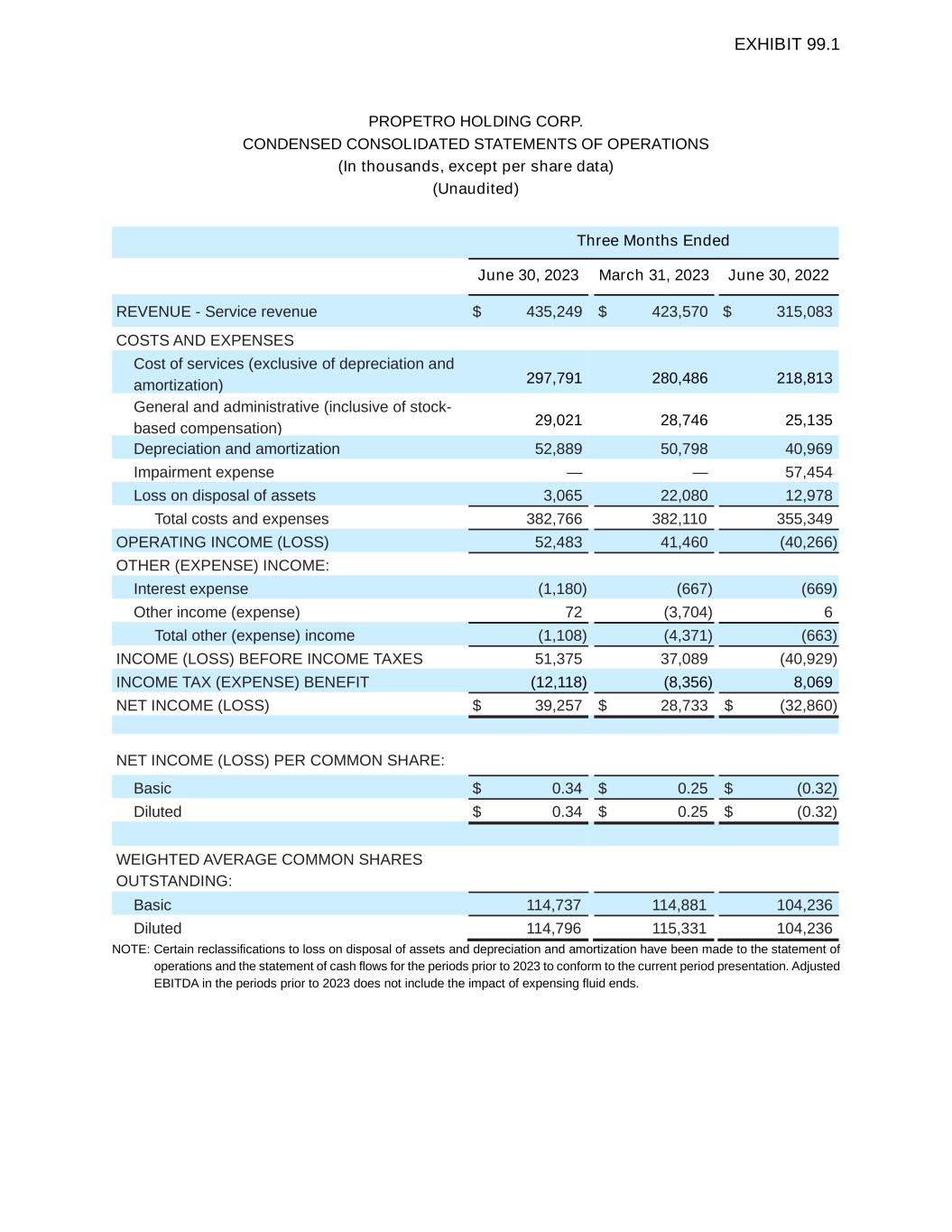

EXHIBIT 99.1 from a diesel-only fleet just a couple of years ago. Our team is excited to deliver these differentiated services to our customers and we expect our strategy to continue to generate improved financial returns.” David Schorlemer, Chief Financial Officer, said, "The second quarter was indicative of the significant investments in our business over the last few years. During the past 18 months and through the end of this year, we will have invested nearly a billion dollars in recapitalizing our hydraulic fracturing fleet and bringing state-of-the-art technologies and completion services to ProPetro, all done while maintaining a strong balance sheet, strong liquidity, and executing on our share repurchase program. We believe efforts like these and other strategic actions create an attractive value proposition for our customers and an opportunity for our shareholders. We expect to yield continued financial returns from these investments for many years to come. The second quarter was our fourth consecutive quarter of increasing net income and as Sam mentioned our highest in over four years. Our results reflect continued strength in net cash provided by operating activities and our free cash flow was positive this quarter and is expected to accelerate in the coming quarters. Since the share repurchase program announcement and through the quarter-end, we repurchased two percent of our outstanding shares at a 27% discount to our share price as of July 31, 2023. Finally and after quarter end, we paid down our ABL Credit Facility by $15 million reducing the balance outstanding to $45 million. This momentum in our financial performance is only eclipsed by the significant investments we expect to benefit from going forward. We are incredibly well positioned for the future and look forward to progressing our strategy further." Second Quarter 2023 Financial Summary Revenue was $435 million, compared to $424 million for the first quarter of 2023. The 3% increase in revenue is attributable to increased utilization across all our service lines. Notably, the Company experienced lost revenues of approximately $15 to $20 million related to an idled frac fleet for over a month and almost twice the weather-related downtime as compared to the second quarter of last year. Cost of services, excluding depreciation and amortization of approximately $51 million relating to cost of services, increased to $298 million from $280 million during the first quarter of 2023. The 6% increase was attributable to the increased operational activity levels across our service lines and unabsorbed labor and related costs of an idled frac fleet in the second quarter of 2023. General and administrative expense of $29 million was unchanged from $29 million in the first quarter of 2023. G&A expense excluding nonrecurring and noncash items (stock-based compensation and other items) of $4 million, was $25 million, or 6% of revenue. Net income, the Company's highest net income since the first quarter of 2019, totaled $39 million, or $0.34 per diluted share, compared to net income of $29 million, or $0.25 per diluted share, for the first quarter of 2023. Adjusted EBITDA decreased to $113 million from $119 million for the first quarter of 2023. The decrease in Adjusted EBITDA was primarily attributable to costs related to higher weather-related downtime and an idled frac fleet during the quarter.

EXHIBIT 99.1 Net cash provided by operating activities was $114 million as compared to $73 million in the prior quarter. Free Cash Flow was approximately $6 million as compared to Free Cash Flow of approximately negative $41 million in the prior quarter. Liquidity and Capital Spending As of June 30, 2023, total cash was $62 million and our borrowings under the ABL Credit Facility were $60 million. Total liquidity at the end of the second quarter of 2023 was $170 million including cash and $108 million of available capacity under the ABL Credit Facility. Since the close of the second quarter we have paid down our ABL Credit Facility by $15 million, and as of July 31, 2023, our cash balance was $63 million and we had $45 million of borrowings under our ABL Credit Facility and $175 million of total liquidity. Capital expenditures incurred during the second quarter of 2023 were $115 million, the majority of which related to maintenance capital expenditures and the Company's previously announced Tier IV DGB dual- fuel conversions. Net cash used in investing activities during the second quarter of 2023 was $108 million. Guidance The Company continues to expect full-year 2023 cash capital expenditures to be in the range of $250 million to $300 million, with a bias toward the upper end of the range. Due to some industry pricing pressures, the Company decided to idle one of its fleets during the second quarter to strategically preserve this fleet and avoid running the equipment at sub-economic levels. The Company expects frac fleet utilization for the second half of 2023 to be between 14 to 15 fleets with 14 fleets active today. Outlook Mr. Sledge added, “Looking ahead, we are on track to deploy our first two FORCESM electric frac fleets in 2023, with deployment of our first fleet planned for this month and the second expected to be deployed early in the fourth quarter. We believe that electric equipment will play a significant role in the future of ProPetro and are pleased to see strong demand for our FORCESM electric frac fleets. Additionally, with our strong balance sheet, we continue to make excellent progress on our strategic initiatives, and we will continue to seek value-accretive acquisition opportunities to further enhance our cash flow profile. We will do all of this in a disciplined and opportunistic manner, prioritizing only high-return prospects that will enhance free cash flow and create incremental shareholder value.” Mr. Sledge concluded, “In the second half of 2023, we remain focused on advancing our strategy and have no intentions of slowing. Despite some near-term headwinds and fears of a broader market slowdown, we expect to achieve consistently strong financial performance and anticipate continued solid demand for our services. ProPetro is differentiated by service quality, a young, next generation equipment offering, a dedicated blue-chip customer portfolio, and operational density in the Permian. This differentiation continues to insulate us from some of the market inconsistency outside the Permian and in the spot market. As we continue to optimize our operations, transition our fleet, and pursue opportunistic transactions, while

EXHIBIT 99.1 maintaining a disciplined asset deployment strategy, we are confident in ProPetro’s future for years to come.” Conference Call Information The Company will host a conference call at 8:00 AM Central Time on Wednesday, August 2, 2023, to discuss financial and operating results for the second quarter of 2023. The call will also be webcast on ProPetro’s website at www.propetroservices.com. To access the conference call, U.S. callers may dial toll free 1-844-340-9046 and international callers may dial 1-412-858-5205. Please call ten minutes ahead of the scheduled start time to ensure a proper connection. A replay of the conference call will be available for one week following the call and can be accessed toll free by dialing 1-877-344-7529 for U.S. callers, 1-855- 669-9658 for Canadian callers, as well as 1-412-317-0088 for international callers. The access code for the replay is 7479217. The Company also posted the scripted remarks on its website. About ProPetro ProPetro Holding Corp. is a Midland, Texas-based provider of premium completion services to leading upstream oil and gas companies engaged in the exploration and production of North American unconventional oil and natural gas resources. We help bring reliable energy to the world. For more information visit www.propetroservices.com. Forward-Looking Statements Except for historical information contained herein, the statements and information in this news release and discussion in the scripted remarks described above are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “may,” “could,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” and other expressions that are predictions of, or indicate, future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include, among other matters, statements about the supply of and demand for hydrocarbons, our business strategy, industry, future profitability, expected fleet utilization, sustainability efforts, the future performance of newly improved technology, expected capital expenditures, the impact of such expenditures on our performance and capital programs and our fleet conversion strategy. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. Although forward-looking statements reflect our good faith beliefs at the time they are made, forward- looking statements are subject to a number of risks and uncertainties that may cause actual events and results to differ materially from the forward-looking statements. Such risks and uncertainties include the volatility of oil prices, the global macroeconomic uncertainty related to the Russia-Ukraine war, general economic conditions, including the impact of continued inflation, central bank policy actions, bank failures, and the risk of a global recession, and other factors described in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, particularly the “Risk Factors” sections of such filings, and other filings with the Securities and Exchange Commission (the “SEC”). In addition, the Company may be subject

EXHIBIT 99.1 to currently unforeseen risks that may have a materially adverse impact on it, including matters related to shareholder litigation. Accordingly, no assurances can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements and are urged to carefully review and consider the various disclosures made in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings made with the SEC from time to time that disclose risks and uncertainties that may affect the Company’s business. The forward-looking statements in this news release are made as of the date of this news release. ProPetro does not undertake, and expressly disclaims, any duty to publicly update these statements, whether as a result of new information, new developments or otherwise, except to the extent that disclosure is required by law. Investor Contacts: David Schorlemer Chief Financial Officer david.schorlemer@propetroservices.com 432-227-0864 Matt Augustine Director, Corporate Development and Investor Relations matt.augustine@propetroservices.com 432-848-0871 ###

EXHIBIT 99.1 PROPETRO HOLDING CORP. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) (Unaudited) Three Months Ended June 30, 2023 March 31, 2023 June 30, 2022 REVENUE - Service revenue $ 435,249 $ 423,570 $ 315,083 COSTS AND EXPENSES Cost of services (exclusive of depreciation and amortization) 297,791 280,486 218,813 General and administrative (inclusive of stock- based compensation) 29,021 28,746 25,135 Depreciation and amortization 52,889 50,798 40,969 Impairment expense — — 57,454 Loss on disposal of assets 3,065 22,080 12,978 Total costs and expenses 382,766 382,110 355,349 OPERATING INCOME (LOSS) 52,483 41,460 (40,266) OTHER (EXPENSE) INCOME: Interest expense (1,180) (667) (669) Other income (expense) 72 (3,704) 6 Total other (expense) income (1,108) (4,371) (663) INCOME (LOSS) BEFORE INCOME TAXES 51,375 37,089 (40,929) INCOME TAX (EXPENSE) BENEFIT (12,118) (8,356) 8,069 NET INCOME (LOSS) $ 39,257 $ 28,733 $ (32,860) NET INCOME (LOSS) PER COMMON SHARE: Basic $ 0.34 $ 0.25 $ (0.32) Diluted $ 0.34 $ 0.25 $ (0.32) WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: Basic 114,737 114,881 104,236 Diluted 114,796 115,331 104,236 NOTE: Certain reclassifications to loss on disposal of assets and depreciation and amortization have been made to the statement of operations and the statement of cash flows for the periods prior to 2023 to conform to the current period presentation. Adjusted EBITDA in the periods prior to 2023 does not include the impact of expensing fluid ends.

EXHIBIT 99.1 PROPETRO HOLDING CORP. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except share data) (Unaudited) June 30, 2023 December 31, 2022 ASSETS CURRENT ASSETS: Cash, cash equivalents and restricted cash $ 62,113 $ 88,862 Accounts receivable - net of allowance for credit losses of $202 and $419, respectively 251,104 215,925 Inventories 18,159 5,034 Prepaid expenses 8,607 8,643 Short-term investment, net 6,437 10,283 Other current assets 704 38 Total current assets 347,124 328,785 PROPERTY AND EQUIPMENT - net of accumulated depreciation 1,001,109 922,735 OPERATING LEASE RIGHT-OF-USE ASSETS 5,672 3,147 OTHER NONCURRENT ASSETS: Goodwill 23,624 23,624 Intangible assets - net of amortization 53,480 56,345 Other noncurrent assets 2,370 1,150 Total other noncurrent assets 79,474 81,119 TOTAL ASSETS $ 1,433,379 $ 1,335,786 LIABILITIES AND SHAREHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $ 218,147 $ 234,299 Operating lease liabilities 1,125 854 Accrued and other current liabilities 57,022 49,027 Total current liabilities 276,294 284,180 DEFERRED INCOME TAXES 84,162 65,265 LONG-TERM DEBT 60,000 30,000 NONCURRENT OPERATING LEASE LIABILITIES 4,564 2,308 Total liabilities 425,020 381,753 COMMITMENTS AND CONTINGENCIES SHAREHOLDERS’ EQUITY: Preferred stock, $0.001 par value, 30,000,000 shares authorized, none issued, respectively — — Common stock, $0.001 par value, 200,000,000 shares authorized, 112,957,976 and 114,515,008 shares issued, respectively 113 114 Additional paid-in capital 956,856 970,519 Retained earnings (accumulated deficit) 51,390 (16,600) Total shareholders’ equity 1,008,359 954,033 TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 1,433,379 $ 1,335,786

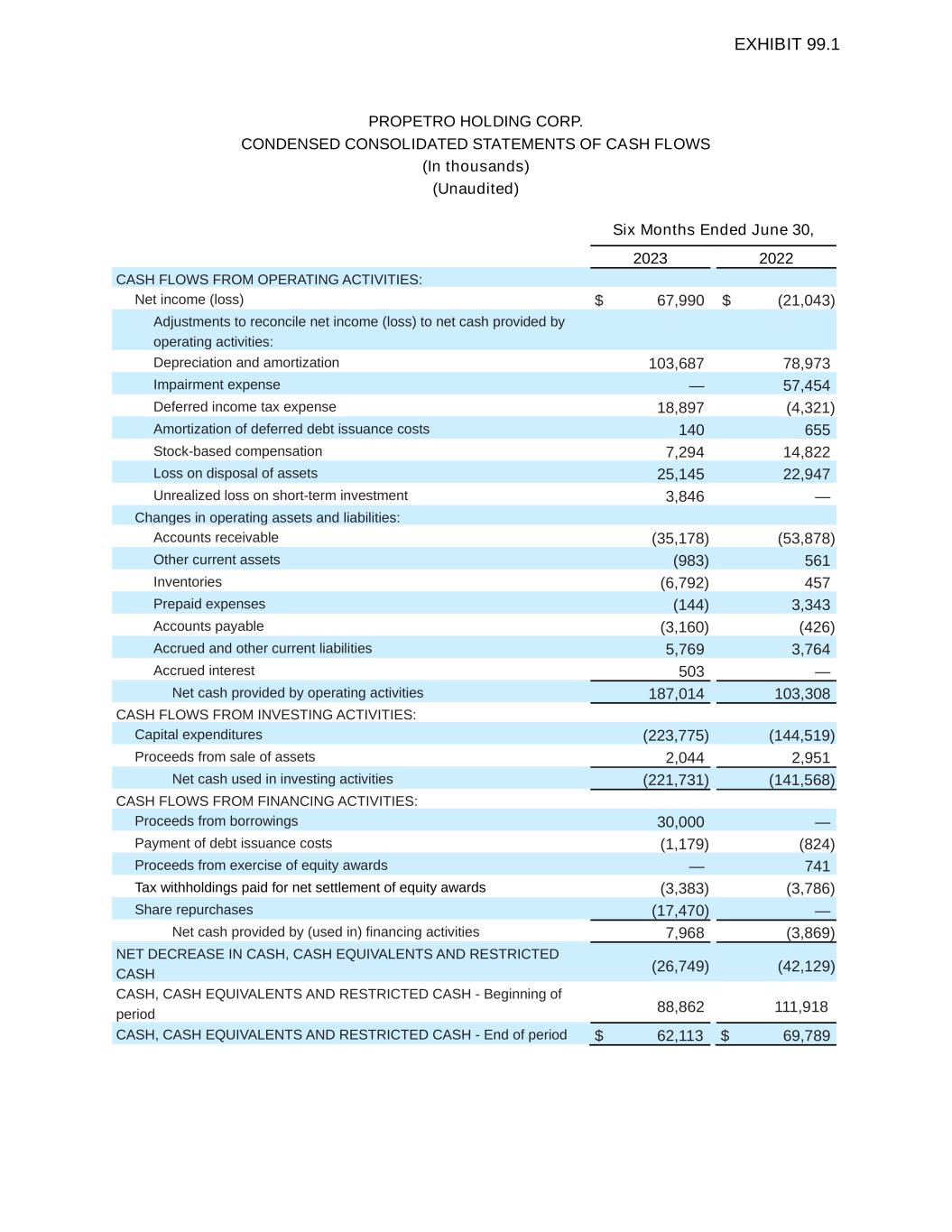

EXHIBIT 99.1 PROPETRO HOLDING CORP. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) Six Months Ended June 30, 2023 2022 CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) $ 67,990 $ (21,043) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation and amortization 103,687 78,973 Impairment expense — 57,454 Deferred income tax expense 18,897 (4,321) Amortization of deferred debt issuance costs 140 655 Stock-based compensation 7,294 14,822 Loss on disposal of assets 25,145 22,947 Unrealized loss on short-term investment 3,846 — Changes in operating assets and liabilities: Accounts receivable (35,178) (53,878) Other current assets (983) 561 Inventories (6,792) 457 Prepaid expenses (144) 3,343 Accounts payable (3,160) (426) Accrued and other current liabilities 5,769 3,764 Accrued interest 503 — Net cash provided by operating activities 187,014 103,308 CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (223,775) (144,519) Proceeds from sale of assets 2,044 2,951 Net cash used in investing activities (221,731) (141,568) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from borrowings 30,000 — Payment of debt issuance costs (1,179) (824) Proceeds from exercise of equity awards — 741 Tax withholdings paid for net settlement of equity awards (3,383) (3,786) Share repurchases (17,470) — Net cash provided by (used in) financing activities 7,968 (3,869) NET DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH (26,749) (42,129) CASH, CASH EQUIVALENTS AND RESTRICTED CASH - Beginning of period 88,862 111,918 CASH, CASH EQUIVALENTS AND RESTRICTED CASH - End of period $ 62,113 $ 69,789

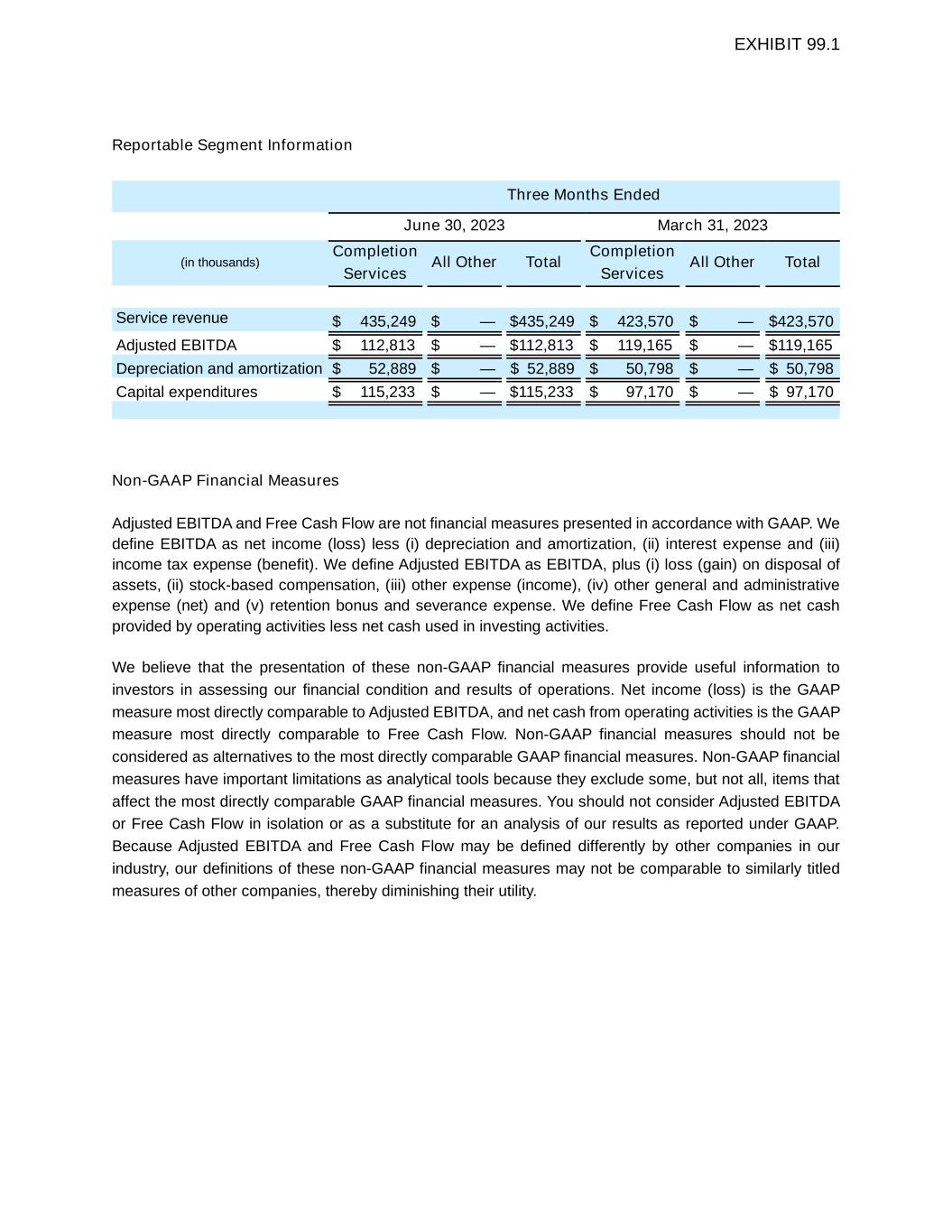

EXHIBIT 99.1 Reportable Segment Information Three Months Ended June 30, 2023 March 31, 2023 (in thousands) Completion Services All Other Total Completion Services All Other Total Service revenue $ 435,249 $ — $ 435,249 $ 423,570 $ — $ 423,570 Adjusted EBITDA $ 112,813 $ — $ 112,813 $ 119,165 $ — $ 119,165 Depreciation and amortization $ 52,889 $ — $ 52,889 $ 50,798 $ — $ 50,798 Capital expenditures $ 115,233 $ — $ 115,233 $ 97,170 $ — $ 97,170 Non-GAAP Financial Measures Adjusted EBITDA and Free Cash Flow are not financial measures presented in accordance with GAAP. We define EBITDA as net income (loss) less (i) depreciation and amortization, (ii) interest expense and (iii) income tax expense (benefit). We define Adjusted EBITDA as EBITDA, plus (i) loss (gain) on disposal of assets, (ii) stock-based compensation, (iii) other expense (income), (iv) other general and administrative expense (net) and (v) retention bonus and severance expense. We define Free Cash Flow as net cash provided by operating activities less net cash used in investing activities. We believe that the presentation of these non-GAAP financial measures provide useful information to investors in assessing our financial condition and results of operations. Net income (loss) is the GAAP measure most directly comparable to Adjusted EBITDA, and net cash from operating activities is the GAAP measure most directly comparable to Free Cash Flow. Non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Non-GAAP financial measures have important limitations as analytical tools because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider Adjusted EBITDA or Free Cash Flow in isolation or as a substitute for an analysis of our results as reported under GAAP. Because Adjusted EBITDA and Free Cash Flow may be defined differently by other companies in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

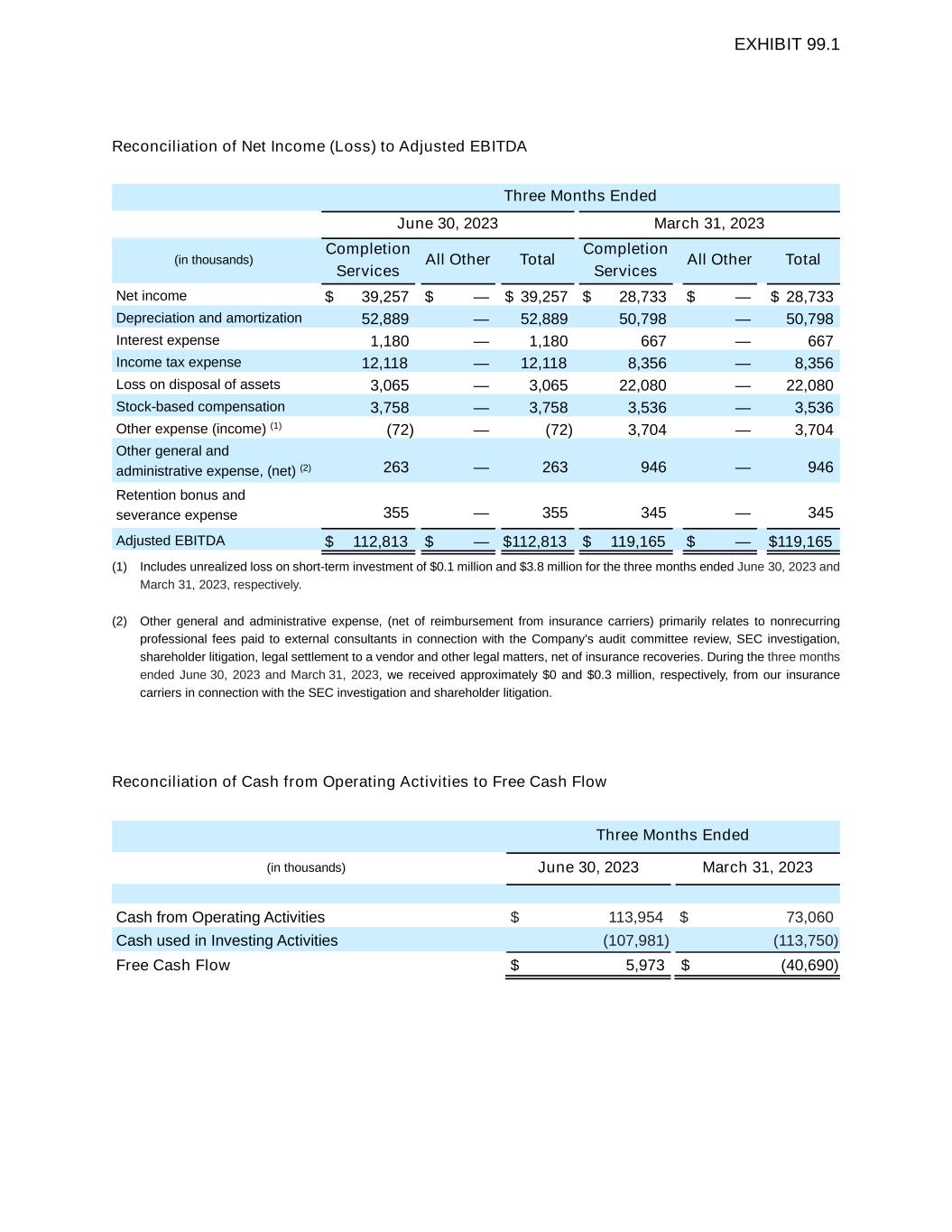

EXHIBIT 99.1 Reconciliation of Net Income (Loss) to Adjusted EBITDA Three Months Ended June 30, 2023 March 31, 2023 (in thousands) Completion Services All Other Total Completion Services All Other Total Net income $ 39,257 $ — $ 39,257 $ 28,733 $ — $ 28,733 Depreciation and amortization 52,889 — 52,889 50,798 — 50,798 Interest expense 1,180 — 1,180 667 — 667 Income tax expense 12,118 — 12,118 8,356 — 8,356 Loss on disposal of assets 3,065 — 3,065 22,080 — 22,080 Stock-based compensation 3,758 — 3,758 3,536 — 3,536 Other expense (income) (1) (72) — (72) 3,704 — 3,704 Other general and administrative expense, (net) (2) 263 — 263 946 — 946 Retention bonus and severance expense 355 — 355 345 — 345 Adjusted EBITDA $ 112,813 $ — $ 112,813 $ 119,165 $ — $ 119,165 (1) Includes unrealized loss on short-term investment of $0.1 million and $3.8 million for the three months ended June 30, 2023 and March 31, 2023, respectively. (2) Other general and administrative expense, (net of reimbursement from insurance carriers) primarily relates to nonrecurring professional fees paid to external consultants in connection with the Company's audit committee review, SEC investigation, shareholder litigation, legal settlement to a vendor and other legal matters, net of insurance recoveries. During the three months ended June 30, 2023 and March 31, 2023, we received approximately $0 and $0.3 million, respectively, from our insurance carriers in connection with the SEC investigation and shareholder litigation. Reconciliation of Cash from Operating Activities to Free Cash Flow Three Months Ended (in thousands) June 30, 2023 March 31, 2023 Cash from Operating Activities $ 113,954 $ 73,060 Cash used in Investing Activities (107,981) (113,750) Free Cash Flow $ 5,973 $ (40,690)