EX-99.2

Published on February 21, 2024

Investor Presentation Fourth Quarter and Full Year 2023 February 21, 2024 EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 2 Forward-Looking Statements Except for historical information contained herein, the statements and information in this presentation, including the oral statements made in connection herewith, are forward- looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “may,” “could,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “will,” “should” and other expressions that are predictions of, or indicate, future events and trends or that do not relate to historical matters generally identify forward-looking statements. Our forward-looking statements include, among other matters, statements about the supply of and demand for hydrocarbons, our business strategy, industry, projected financial results and future financial performance, expected fleet utilization, sustainability efforts, the future performance of newly improved technology, expected capital expenditures, the impact of such expenditures on our performance and capital programs, our fleet conversion strategy and our share repurchase program. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. Although forward-looking statements reflect our good faith beliefs at the time they are made, forward-looking statements are subject to a number of risks and uncertainties that may cause actual events and results to differ materially from the forward-looking statements. Such risks and uncertainties include the volatility of oil prices, the global macroeconomic uncertainty related to the conflict in the Israel-Gaza region and the Russia-Ukraine war, general economic conditions, including impact of continued inflation, central bank policy actions, bank failures and the risk of a global recession and other factors described in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, particularly the “Risk Factors” sections of such filings, and other filings with the Securities and Exchange Commission (the “SEC”). In addition, we may be subject to currently unforeseen risks that may have a materially adverse impact on us. Accordingly, no assurances can be given that the actual events and results will not be materially different from the anticipated results described in the forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements and are urged to carefully review and consider the various disclosures made in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings made with the SEC from time to time that disclose risks and uncertainties that may affect our business. The forward-looking statements in this presentation are made as of the date of this presentation. We do not undertake, and expressly disclaim, any duty to publicly update these statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure is required by law. This presentation contains certain measures that are not determined in accordance with GAAP. For a definition of these measures and a reconciliation to the most directly comparable GAAP measure on a historical basis, please see the reconciliations on slide 3 and 4. EXHIBIT 99.2

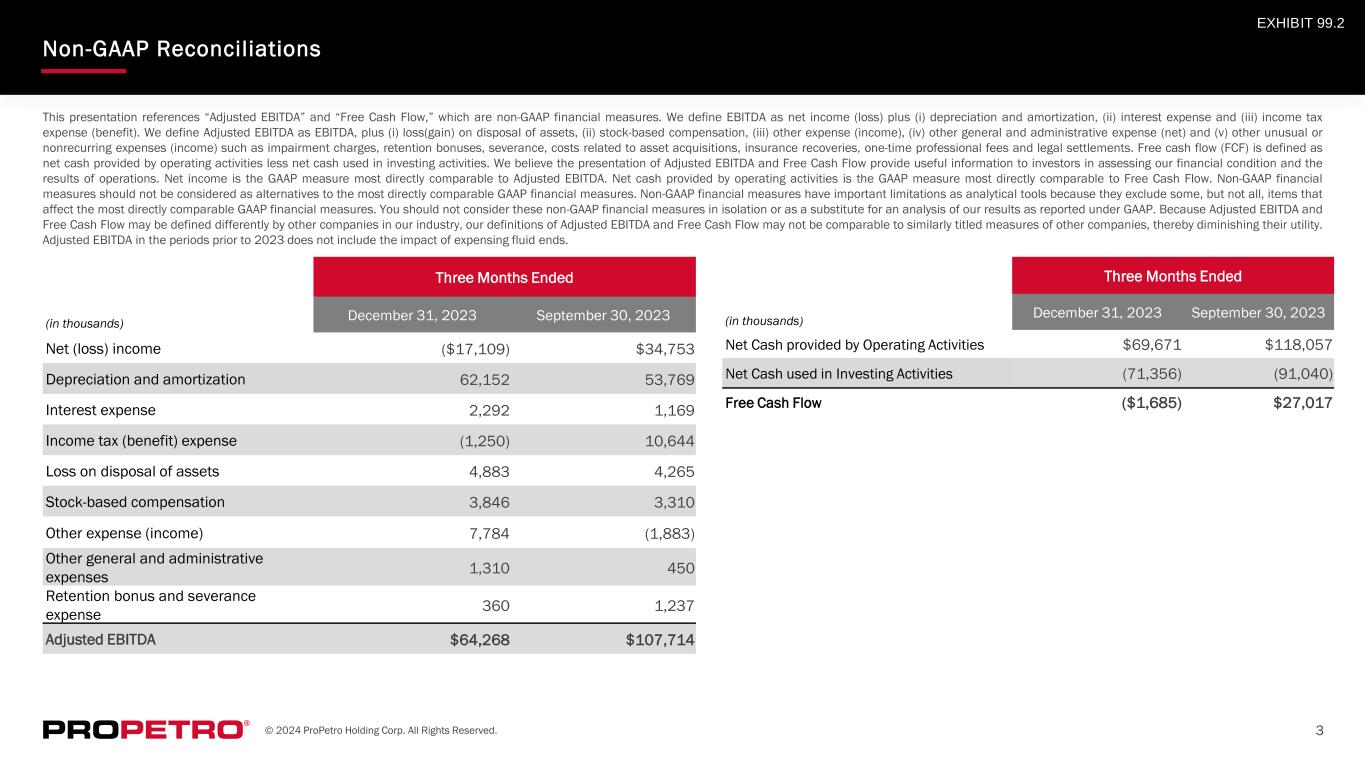

© 2024 ProPetro Holding Corp. All Rights Reserved. 3 This presentation references “Adjusted EBITDA” and “Free Cash Flow,” which are non-GAAP financial measures. We define EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest expense and (iii) income tax expense (benefit). We define Adjusted EBITDA as EBITDA, plus (i) loss(gain) on disposal of assets, (ii) stock-based compensation, (iii) other expense (income), (iv) other general and administrative expense (net) and (v) other unusual or nonrecurring expenses (income) such as impairment charges, retention bonuses, severance, costs related to asset acquisitions, insurance recoveries, one-time professional fees and legal settlements. Free cash flow (FCF) is defined as net cash provided by operating activities less net cash used in investing activities. We believe the presentation of Adjusted EBITDA and Free Cash Flow provide useful information to investors in assessing our financial condition and the results of operations. Net income is the GAAP measure most directly comparable to Adjusted EBITDA. Net cash provided by operating activities is the GAAP measure most directly comparable to Free Cash Flow. Non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Non-GAAP financial measures have important limitations as analytical tools because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider these non-GAAP financial measures in isolation or as a substitute for an analysis of our results as reported under GAAP. Because Adjusted EBITDA and Free Cash Flow may be defined differently by other companies in our industry, our definitions of Adjusted EBITDA and Free Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Adjusted EBITDA in the periods prior to 2023 does not include the impact of expensing fluid ends. Non-GAAP Reconciliations Three Months Ended (in thousands) December 31, 2023 September 30, 2023 Net (loss) income ($17,109) $34,753 Depreciation and amortization 62,152 53,769 Interest expense 2,292 1,169 Income tax (benefit) expense (1,250) 10,644 Loss on disposal of assets 4,883 4,265 Stock-based compensation 3,846 3,310 Other expense (income) 7,784 (1,883) Other general and administrative expenses 1,310 450 Retention bonus and severance expense 360 1,237 Adjusted EBITDA $64,268 $107,714 Three Months Ended (in thousands) December 31, 2023 September 30, 2023 Net Cash provided by Operating Activities $69,671 $118,057 Net Cash used in Investing Activities (71,356) (91,040) Free Cash Flow ($1,685) $27,017 EXHIBIT 99.2

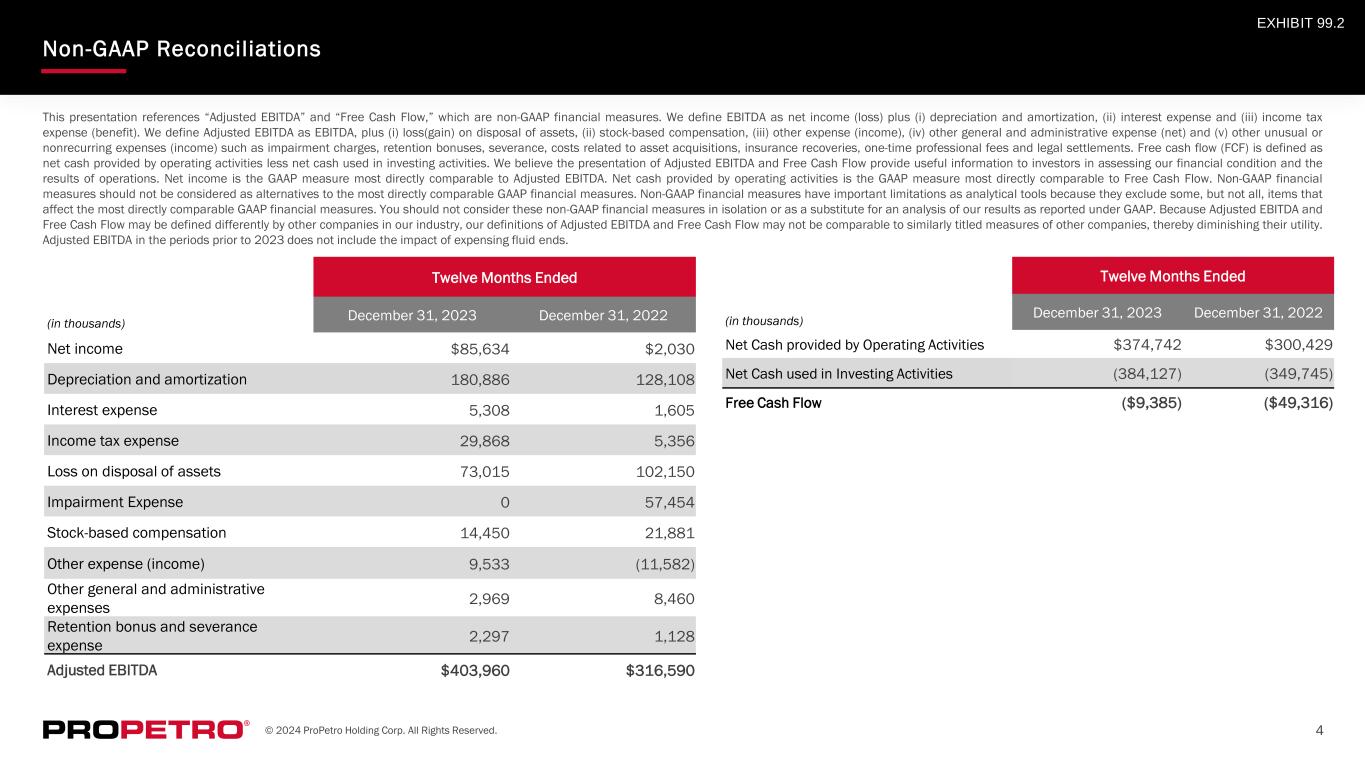

© 2024 ProPetro Holding Corp. All Rights Reserved. 4 This presentation references “Adjusted EBITDA” and “Free Cash Flow,” which are non-GAAP financial measures. We define EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest expense and (iii) income tax expense (benefit). We define Adjusted EBITDA as EBITDA, plus (i) loss(gain) on disposal of assets, (ii) stock-based compensation, (iii) other expense (income), (iv) other general and administrative expense (net) and (v) other unusual or nonrecurring expenses (income) such as impairment charges, retention bonuses, severance, costs related to asset acquisitions, insurance recoveries, one-time professional fees and legal settlements. Free cash flow (FCF) is defined as net cash provided by operating activities less net cash used in investing activities. We believe the presentation of Adjusted EBITDA and Free Cash Flow provide useful information to investors in assessing our financial condition and the results of operations. Net income is the GAAP measure most directly comparable to Adjusted EBITDA. Net cash provided by operating activities is the GAAP measure most directly comparable to Free Cash Flow. Non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Non-GAAP financial measures have important limitations as analytical tools because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider these non-GAAP financial measures in isolation or as a substitute for an analysis of our results as reported under GAAP. Because Adjusted EBITDA and Free Cash Flow may be defined differently by other companies in our industry, our definitions of Adjusted EBITDA and Free Cash Flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Adjusted EBITDA in the periods prior to 2023 does not include the impact of expensing fluid ends. Non-GAAP Reconciliations Twelve Months Ended (in thousands) December 31, 2023 December 31, 2022 Net income $85,634 $2,030 Depreciation and amortization 180,886 128,108 Interest expense 5,308 1,605 Income tax expense 29,868 5,356 Loss on disposal of assets 73,015 102,150 Impairment Expense 0 57,454 Stock-based compensation 14,450 21,881 Other expense (income) 9,533 (11,582) Other general and administrative expenses 2,969 8,460 Retention bonus and severance expense 2,297 1,128 Adjusted EBITDA $403,960 $316,590 Twelve Months Ended (in thousands) December 31, 2023 December 31, 2022 Net Cash provided by Operating Activities $374,742 $300,429 Net Cash used in Investing Activities (384,127) (349,745) Free Cash Flow ($9,385) ($49,316) EXHIBIT 99.2

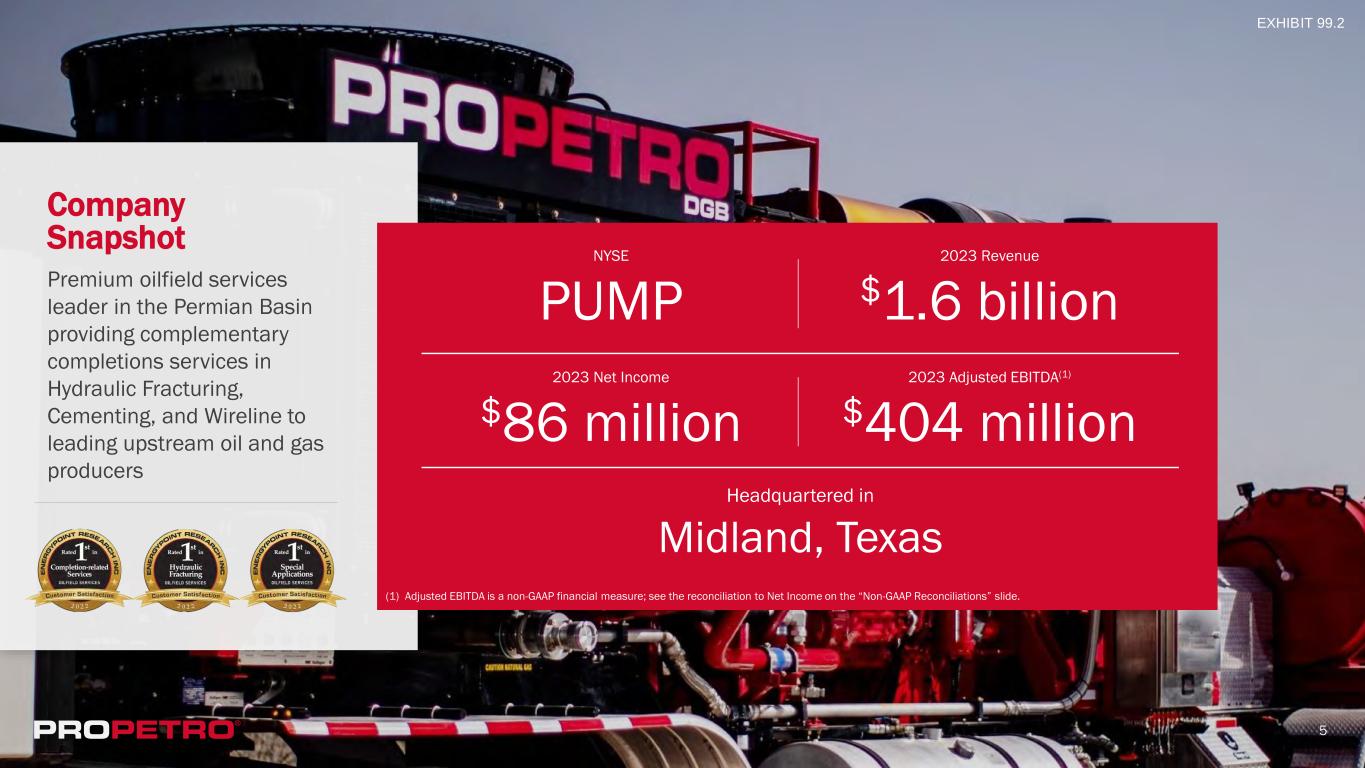

© 2024 ProPetro Holding Corp. All Rights Reserved. 5 CCC Company Snapshot Premium oilfield services leader in the Permian Basin providing complementary completions services in Hydraulic Fracturing, Cementing, and Wireline to leading upstream oil and gas producers 5 NYSE PUMP 2023 Revenue $1.6 billion 2023 Net Income $86 million 2023 Adjusted EBITDA(1) $404 million Headquartered in Midland, Texas (1) Adjusted EBITDA is a non-GAAP financial measure; see the reconciliation to Net Income on the “Non-GAAP Reconciliations” slide. EXHIBIT 99.2

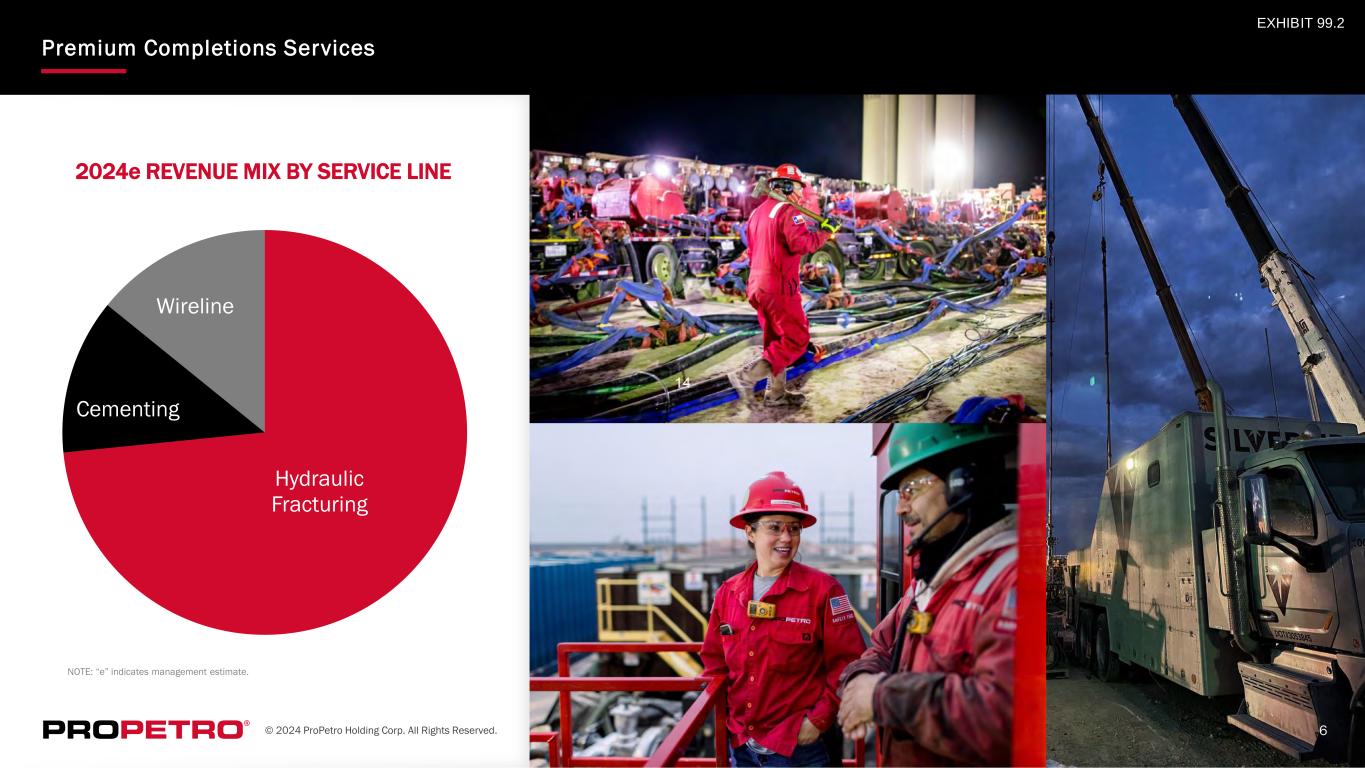

© 2024 ProPetro Holding Corp. All Rights Reserved. 66 Premium Completions Services 2024e REVENUE MIX BY SERVICE LINE Hydraulic Fracturing Cementing Wireline NOTE: “e” indicates management estimate. EXHIBIT 99.2

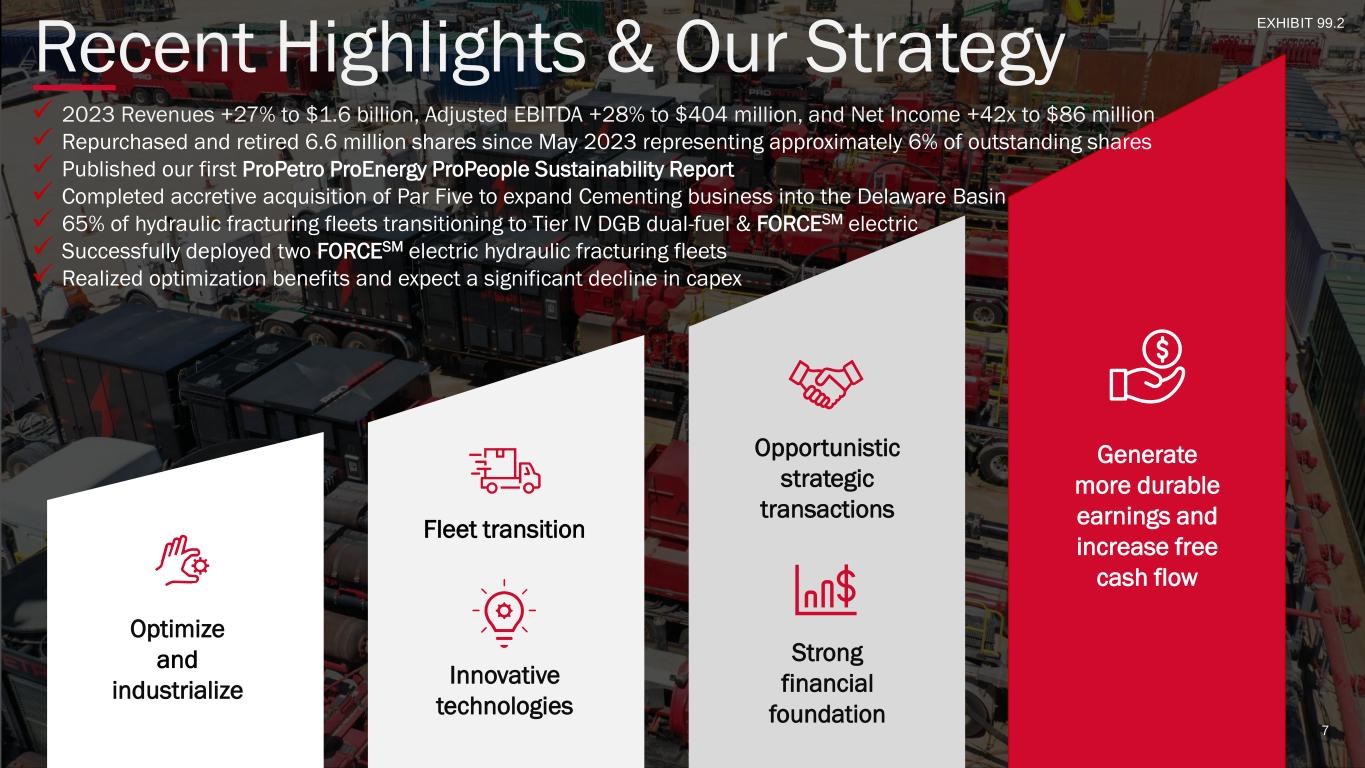

© 2024 ProPetro Holding Corp. All Rights Reserved. 7 Recent Highlights & Our Strategy 7 ✓ 2023 Revenues +27% to $1.6 billion, Adjusted EBITDA +28% to $404 million, and Net Income +42x to $86 million ✓ Repurchased and retired 6.6 million shares since May 2023 representing approximately 6% of outstanding shares ✓ Published our first ProPetro ProEnergy ProPeople Sustainability Report ✓ Completed accretive acquisition of Par Five to expand Cementing business into the Delaware Basin ✓ 65% of hydraulic fracturing fleets transitioning to Tier IV DGB dual-fuel & FORCESM electric ✓ Successfully deployed two FORCESM electric hydraulic fracturing fleets ✓ Realized optimization benefits and expect a significant decline in capex Fleet transition Opportunistic strategic transactions Optimize and industrialize Strong financial foundation Innovative technologies Generate more durable earnings and increase free cash flow EXHIBIT 99.2

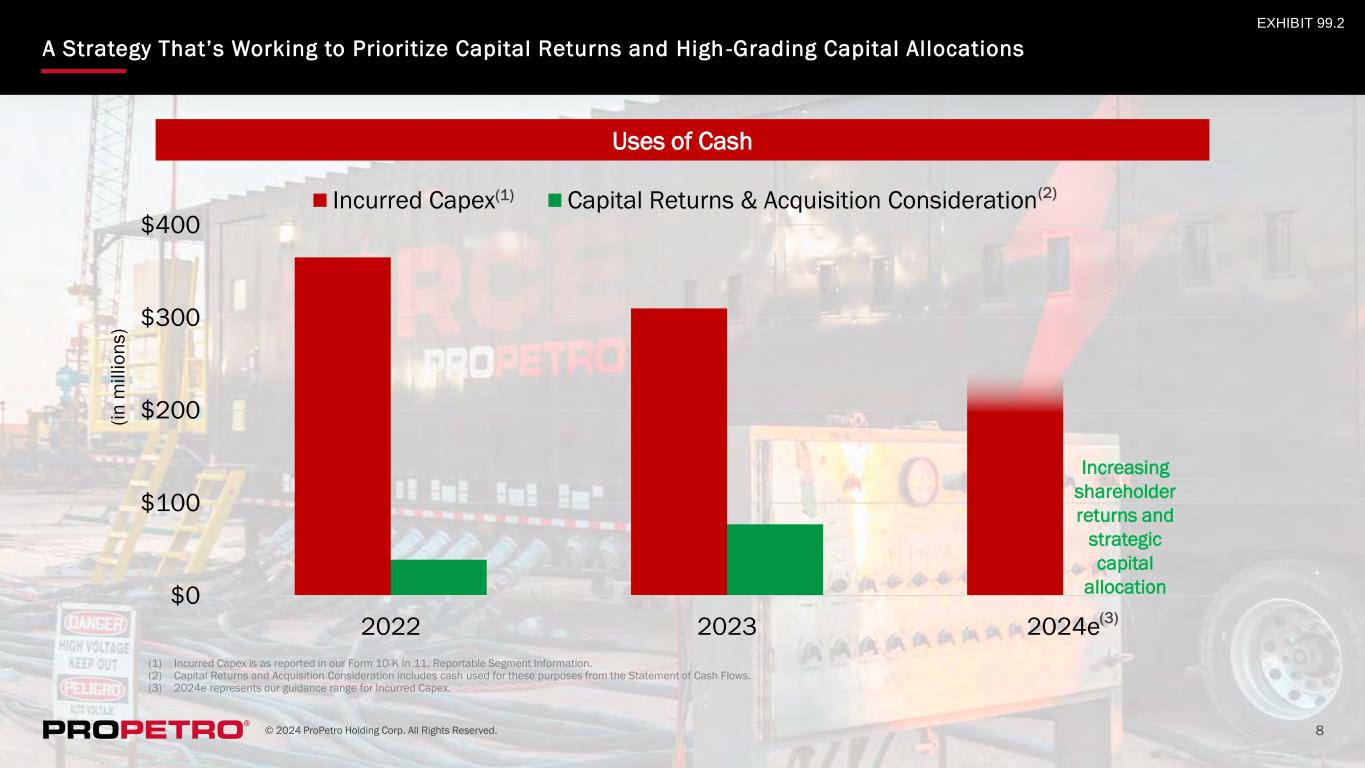

© 2024 ProPetro Holding Corp. All Rights Reserved. 8 $0 $100 $200 $300 $400 2022 2023 2024e (i n m il li o n s ) Incurred Capex Capital Returns & Acquisition Consideration Uses of Cash (1) Incurred Capex is as reported in our Form 10-K in 11. Reportable Segment Information. (2) Capital Returns and Acquisition Consideration includes cash used for these purposes from the Statement of Cash Flows. (3) 2024e represents our guidance range for Incurred Capex. A Strategy That’s Working to Prioritize Capital Returns and High -Grading Capital Allocations (2)(1) (3) Increasing shareholder returns and strategic capital allocation EXHIBIT 99.2

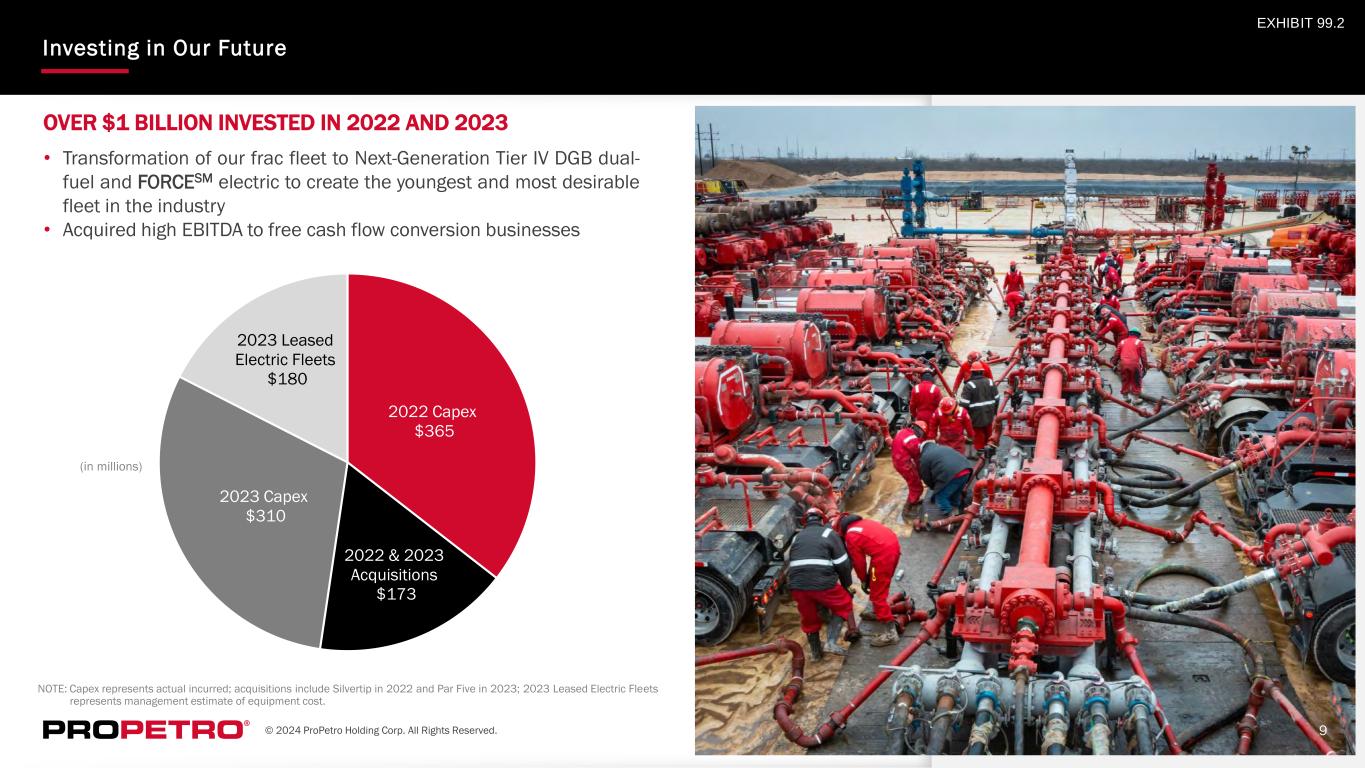

© 2024 ProPetro Holding Corp. All Rights Reserved. 99 Investing in Our Future OVER $1 BILLION INVESTED IN 2022 AND 2023 2022 Capex $365 2022 & 2023 Acquisitions $173 2023 Capex $310 2023 Leased Electric Fleets $180 • Transformation of our frac fleet to Next-Generation Tier IV DGB dual- fuel and FORCESM electric to create the youngest and most desirable fleet in the industry • Acquired high EBITDA to free cash flow conversion businesses (in millions) NOTE: Capex represents actual incurred; acquisitions include Silvertip in 2022 and Par Five in 2023; 2023 Leased Electric Fleets represents management estimate of equipment cost. EXHIBIT 99.2

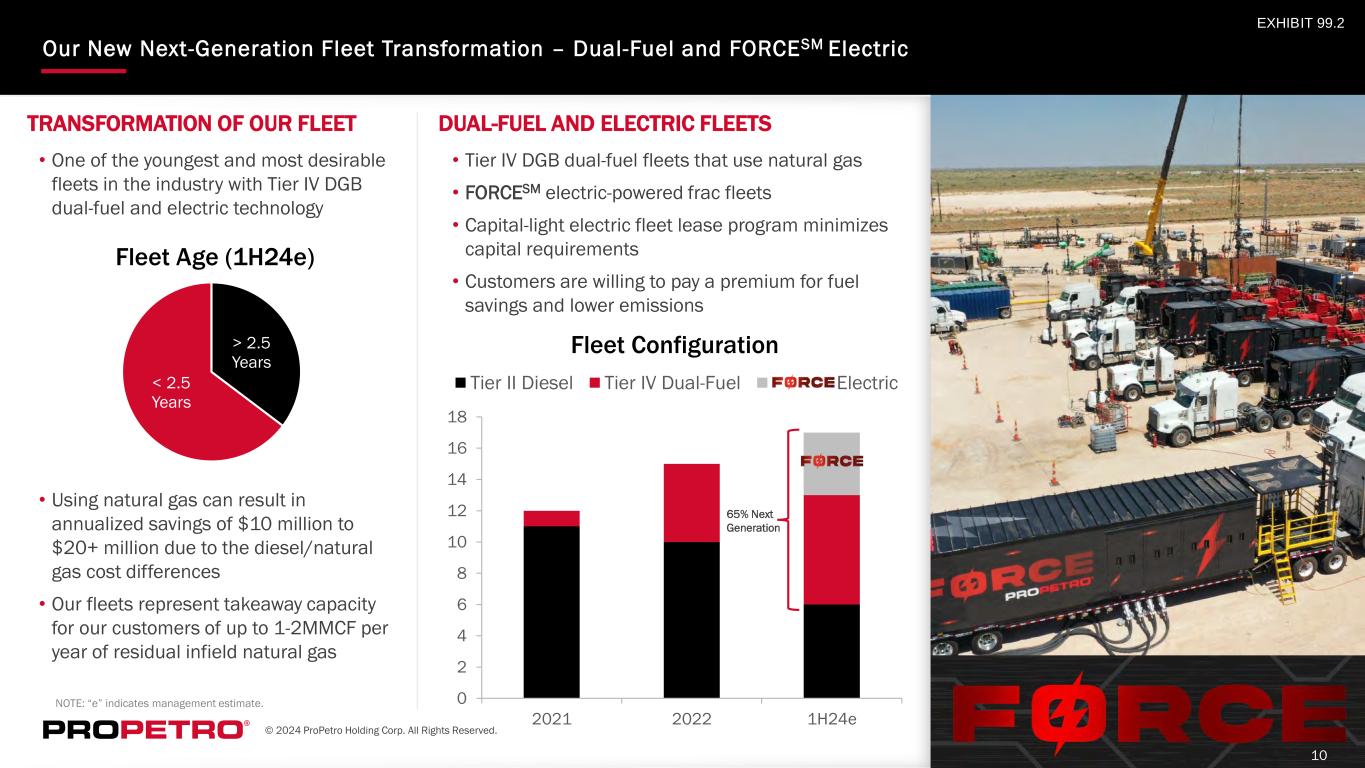

© 2024 ProPetro Holding Corp. All Rights Reserved. 10 • Tier IV DGB dual-fuel fleets that use natural gas • FORCESM electric-powered frac fleets • Capital-light electric fleet lease program minimizes capital requirements • Customers are willing to pay a premium for fuel savings and lower emissions Our New Next-Generation Fleet Transformation – Dual-Fuel and FORCESM Electric • One of the youngest and most desirable fleets in the industry with Tier IV DGB dual-fuel and electric technology • Using natural gas can result in annualized savings of $10 million to $20+ million due to the diesel/natural gas cost differences • Our fleets represent takeaway capacity for our customers of up to 1-2MMCF per year of residual infield natural gas TRANSFORMATION OF OUR FLEET DUAL-FUEL AND ELECTRIC FLEETS 0 2 4 6 8 10 12 14 16 18 2021 2022 1H24e Fleet Configuration Tier II Diesel Tier IV Dual-Fuel --- Electric 65% Next Generation > 2.5 Years < 2.5 Years Fleet Age (1H24e) NOTE: “e” indicates management estimate. 10 EXHIBIT 99.2

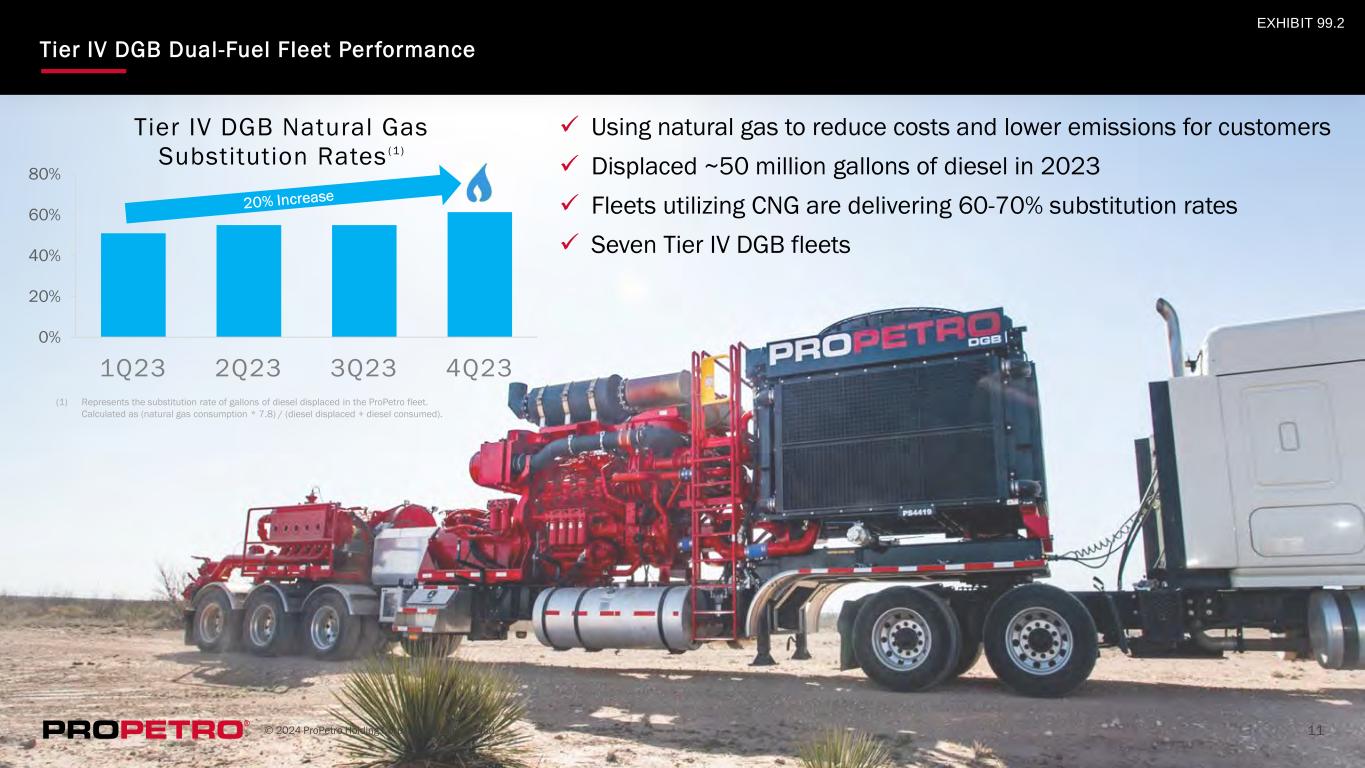

© 2024 ProPetro Holding Corp. All Rights Reserved. 11 ✓ Using natural gas to reduce costs and lower emissions for customers ✓ Displaced ~50 million gallons of diesel in 2023 ✓ Fleets utilizing CNG are delivering 60-70% substitution rates ✓ Seven Tier IV DGB fleets Tier IV DGB Dual-Fuel Fleet Performance 0% 20% 40% 60% 80% 1Q23 2Q23 3Q23 4Q23 Tier IV DGB Natural Gas Substitution Rates (1) (1) Represents the substitution rate of gallons of diesel displaced in the ProPetro fleet. Calculated as (natural gas consumption * 7.8) / (diesel displaced + diesel consumed). EXHIBIT 99.2

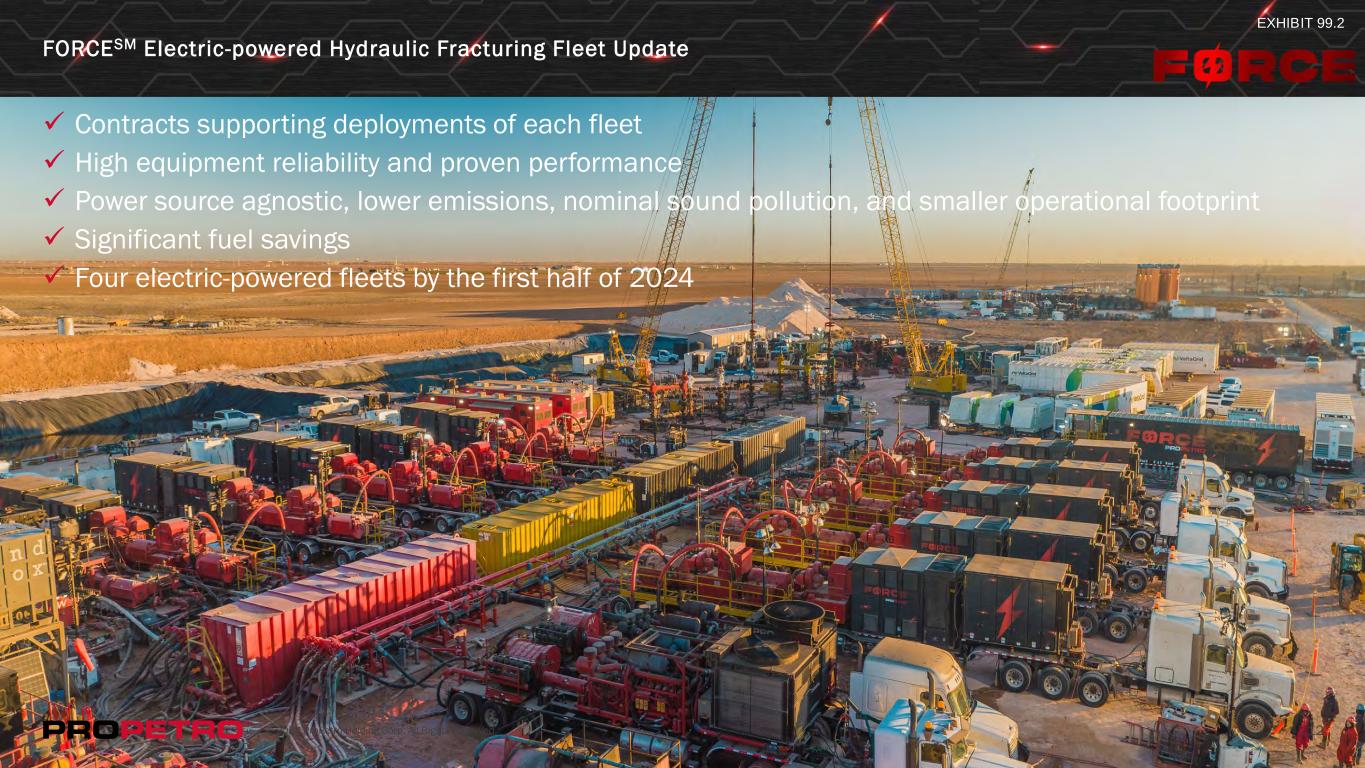

© 2024 ProPetro Holding Corp. All Rights Reserved. 12 ✓ Contracts supporting deployments of each fleet ✓ High equipment reliability and proven performance ✓ Power source agnostic, lower emissions, nominal sound pollution, and smaller operational footprint ✓ Significant fuel savings ✓ Four electric-powered fleets by the first half of 2024 FORCESM Electric-powered Hydraulic Fracturing Fleet Update EXHIBIT 99.2

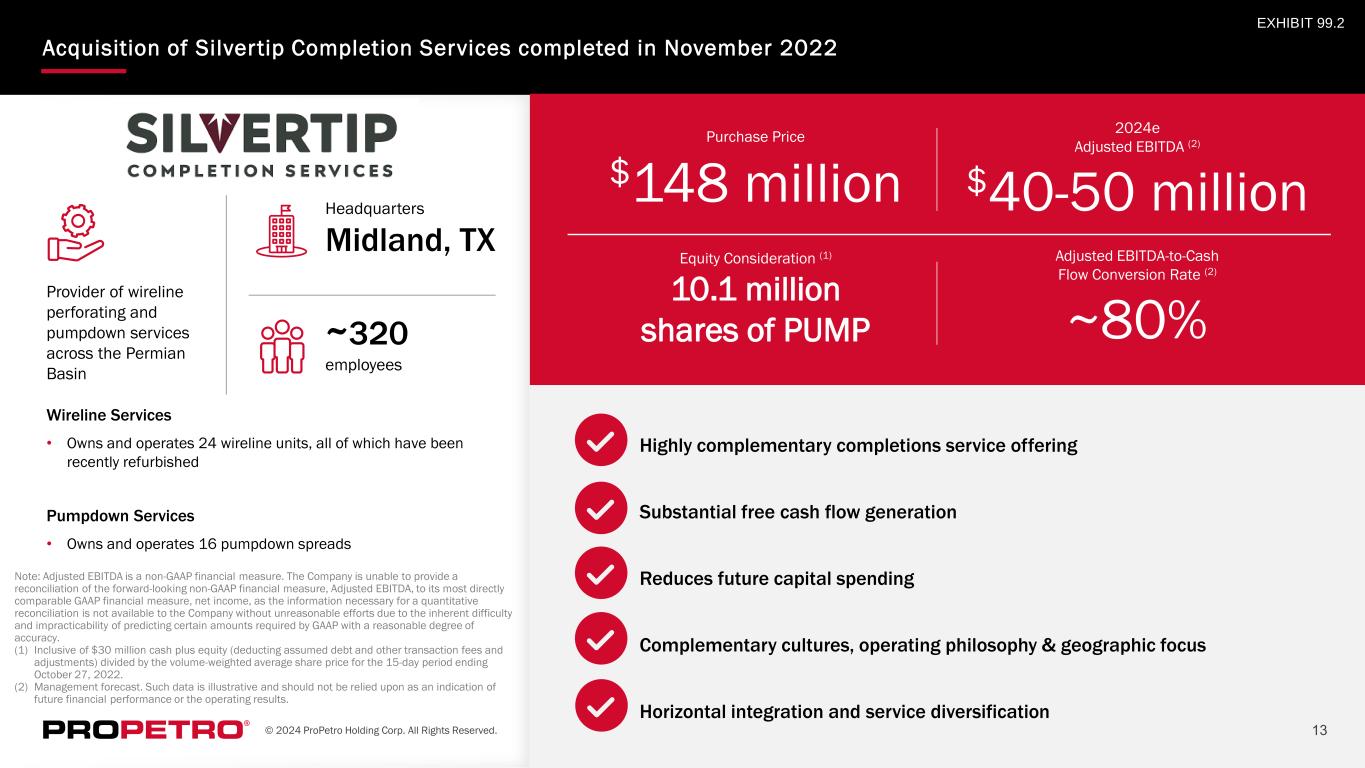

© 2022 ProPetro Holding Corp. All Rights Reserved. 134 13 Headquarters Midland, TX Wireline Services • Owns and operates 24 wireline units, all of which have been recently refurbished Pumpdown Services • Owns and operates 16 pumpdown spreads ~320 employees Provider of wireline perforating and pumpdown services across the Permian Basin Note: Adjusted EBITDA is a non-GAAP financial measure. The Company is unable to provide a reconciliation of the forward-looking non-GAAP financial measure, Adjusted EBITDA, to its most directly comparable GAAP financial measure, net income, as the information necessary for a quantitative reconciliation is not available to the Company without unreasonable efforts due to the inherent difficulty and impracticability of predicting certain amounts required by GAAP with a reasonable degree of accuracy. (1) Inclusive of $30 million cash plus equity (deducting assumed debt and other transaction fees and adjustments) divided by the volume-weighted average share price for the 15-day period ending October 27, 2022. (2) Management forecast. Such data is illustrative and should not be relied upon as an indication of future financial performance or the operating results. Purchase Price $148 million 2024e Adjusted EBITDA (2) $40-50 million Equity Consideration (1) 10.1 million shares of PUMP Adjusted EBITDA-to-Cash Flow Conversion Rate (2) ~80% Highly complementary completions service offering Substantial free cash flow generation Reduces future capital spending Complementary cultures, operating philosophy & geographic focus Horizontal integration and service diversification Acquisition of Silvertip Completion Services completed in November 2022 EXHIBIT 99.2

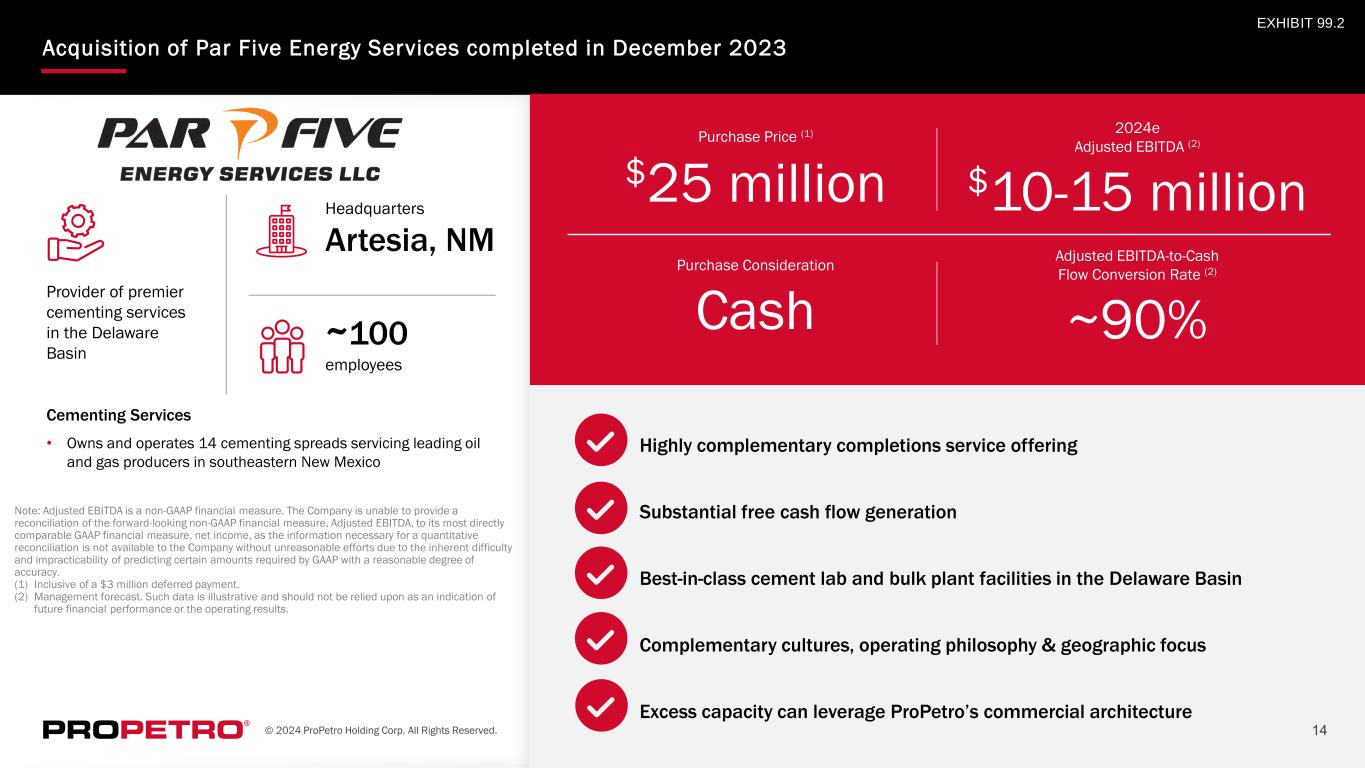

© 2022 ProPetro Holding Corp. All Rights Reserved. 144 14 Headquarters Artesia, NM Cementing Services • Owns and operates 14 cementing spreads servicing leading oil and gas producers in southeastern New Mexico ~100 employees Provider of premier cementing services in the Delaware Basin Note: Adjusted EBITDA is a non-GAAP financial measure. The Company is unable to provide a reconciliation of the forward-looking non-GAAP financial measure, Adjusted EBITDA, to its most directly comparable GAAP financial measure, net income, as the information necessary for a quantitative reconciliation is not available to the Company without unreasonable efforts due to the inherent difficulty and impracticability of predicting certain amounts required by GAAP with a reasonable degree of accuracy. (1) Inclusive of a $3 million deferred payment. (2) Management forecast. Such data is illustrative and should not be relied upon as an indication of future financial performance or the operating results. Purchase Price (1) $25 million 2024e Adjusted EBITDA (2) $10-15 million Purchase Consideration Cash Adjusted EBITDA-to-Cash Flow Conversion Rate (2) ~90% Acquisition of Par Five Energy Services completed in December 2023 Highly complementary completions service offering Substantial free cash flow generation Best-in-class cement lab and bulk plant facilities in the Delaware Basin Complementary cultures, operating philosophy & geographic focus Excess capacity can leverage ProPetro’s commercial architecture EXHIBIT 99.2

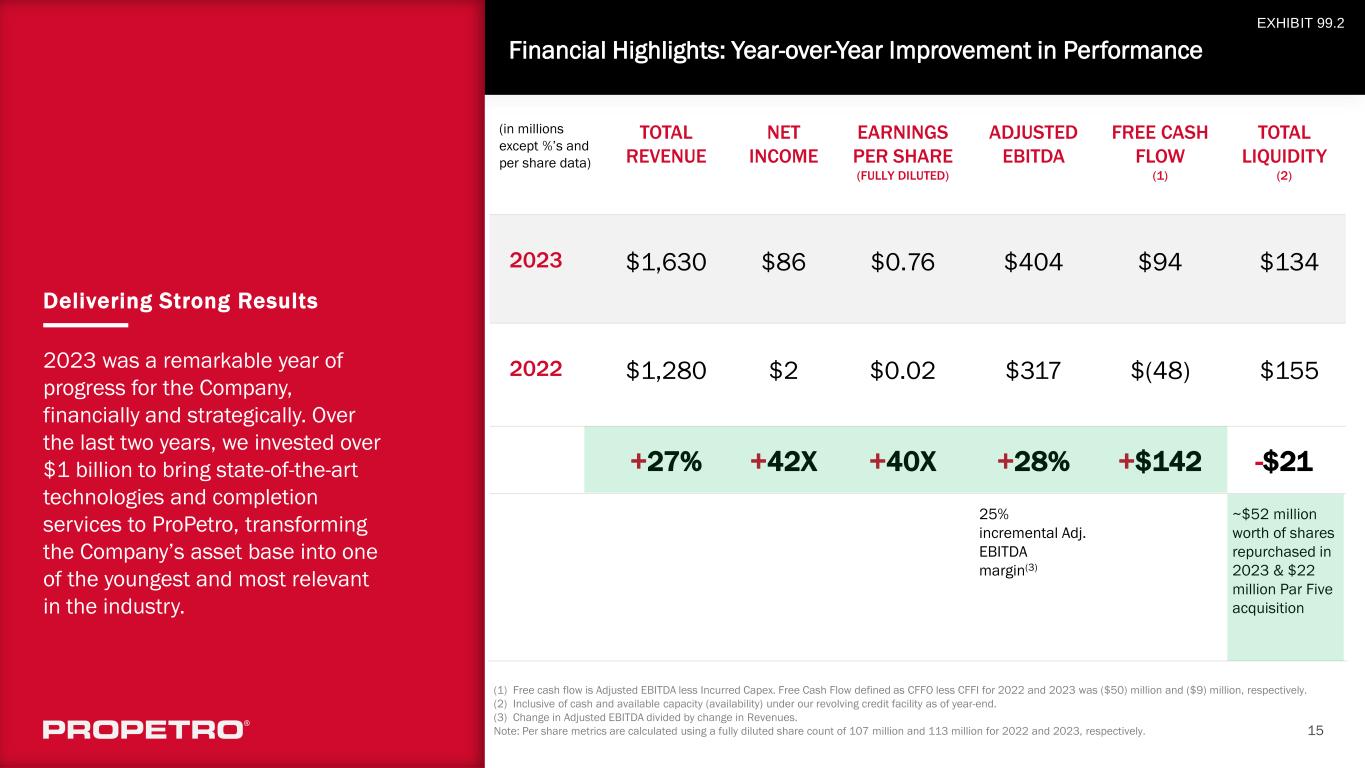

© 2022 ProPetro Holding Corp. All Rights Reserved. 15 (in millions except %’s and per share data) TOTAL REVENUE NET INCOME EARNINGS PER SHARE (FULLY DILUTED) ADJUSTED EBITDA FREE CASH FLOW (1) TOTAL LIQUIDITY (2) 2023 $1,630 $86 $0.76 $404 $94 $134 2022 $1,280 $2 $0.02 $317 $(48) $155 +27% +42X +40X +28% +$142 -$21 25% incremental Adj. EBITDA margin(3) ~$52 million worth of shares repurchased in 2023 & $22 million Par Five acquisition Delivering Strong Results 2023 was a remarkable year of progress for the Company, financially and strategically. Over the last two years, we invested over $1 billion to bring state-of-the-art technologies and completion services to ProPetro, transforming the Company’s asset base into one of the youngest and most relevant in the industry. Financial Highlights: Year-over-Year Improvement in Performance (1) Free cash flow is Adjusted EBITDA less Incurred Capex. Free Cash Flow defined as CFFO less CFFI for 2022 and 2023 was ($50) million and ($9) million, respectively. (2) Inclusive of cash and available capacity (availability) under our revolving credit facility as of year-end. (3) Change in Adjusted EBITDA divided by change in Revenues. Note: Per share metrics are calculated using a fully diluted share count of 107 million and 113 million for 2022 and 2023, respectively. EXHIBIT 99.2

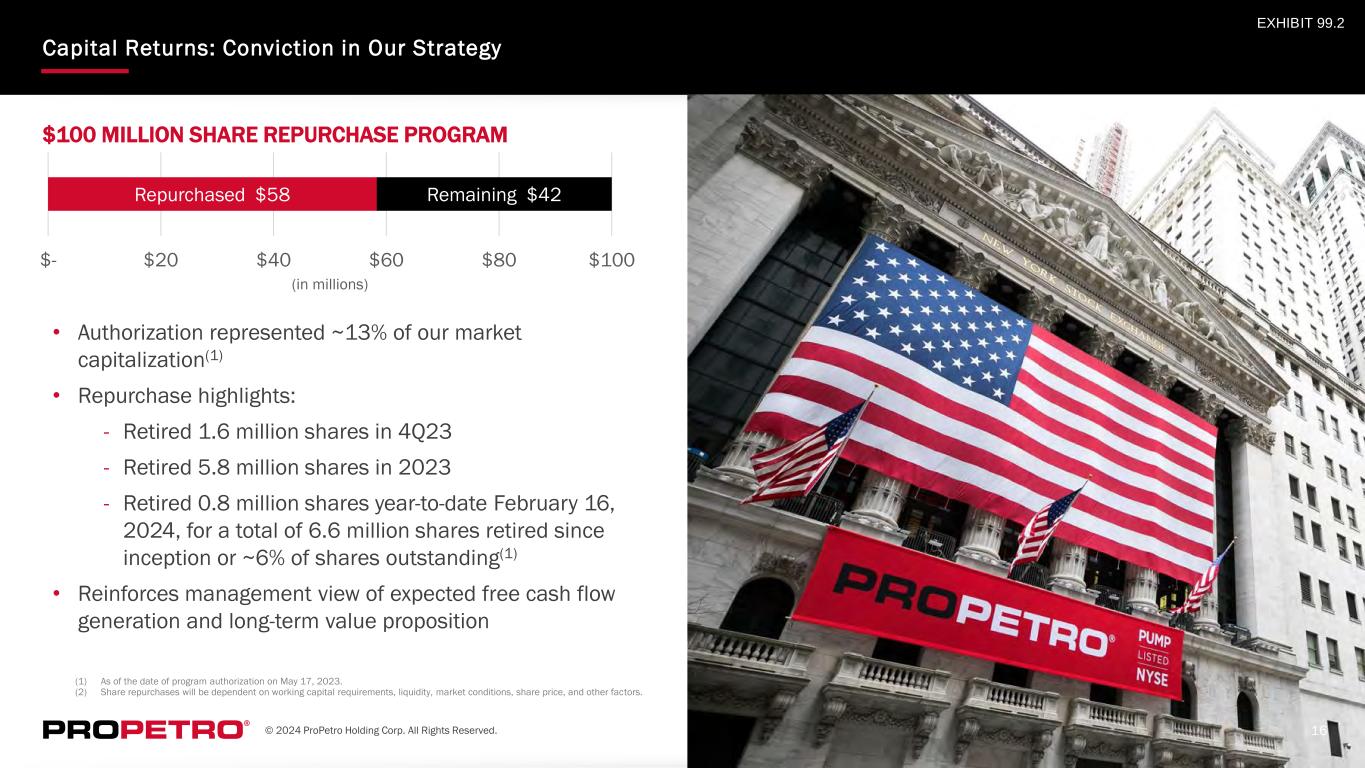

© 2024 ProPetro Holding Corp. All Rights Reserved. 1616 Capital Returns: Conviction in Our Strategy • Authorization represented ~13% of our market capitalization(1) • Repurchase highlights: - Retired 1.6 million shares in 4Q23 - Retired 5.8 million shares in 2023 - Retired 0.8 million shares year-to-date February 16, 2024, for a total of 6.6 million shares retired since inception or ~6% of shares outstanding(1) • Reinforces management view of expected free cash flow generation and long-term value proposition $100 MILLION SHARE REPURCHASE PROGRAM (1) As of the date of program authorization on May 17, 2023. (2) Share repurchases will be dependent on working capital requirements, liquidity, market conditions, share price, and other factors. Repurchased $58 Remaining $42 $- $20 $40 $60 $80 $100 (in millions) EXHIBIT 99.2

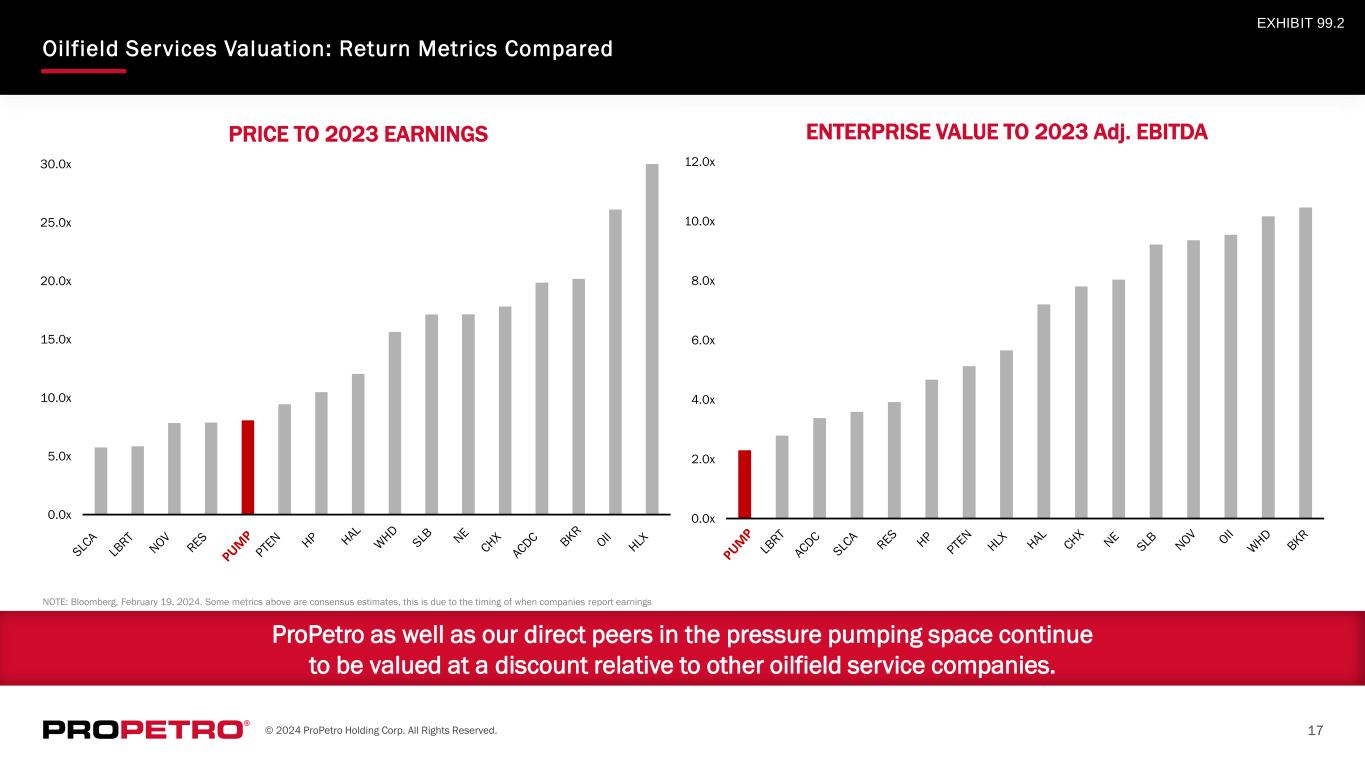

© 2024 ProPetro Holding Corp. All Rights Reserved. 17 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x ENTERPRISE VALUE TO 2023 Adj. EBITDA 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x PRICE TO 2023 EARNINGS Oilfield Services Valuation: Return Metrics Compared NOTE: Bloomberg, February 19, 2024. Some metrics above are consensus estimates, this is due to the timing of when companies report earnings ProPetro as well as our direct peers in the pressure pumping space continue to be valued at a discount relative to other oilfield service companies. EXHIBIT 99.2

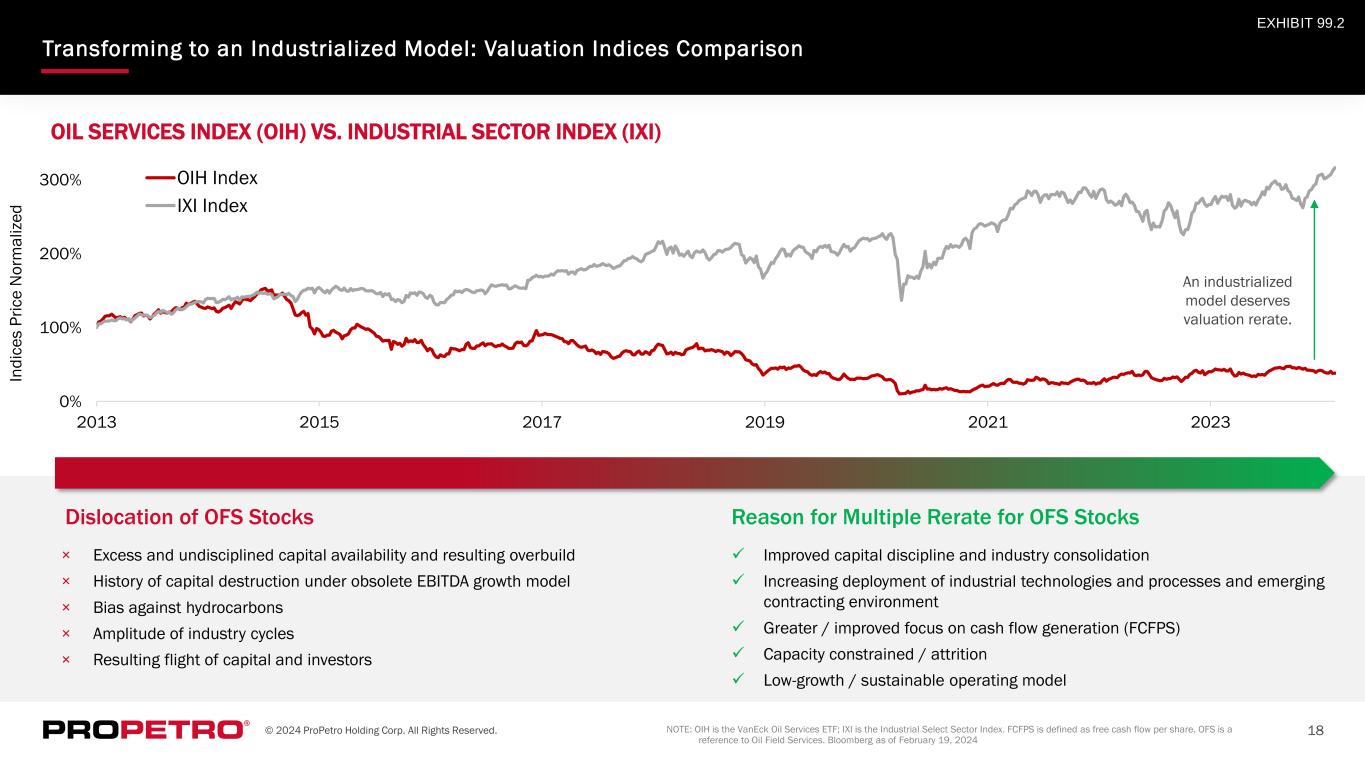

© 2024 ProPetro Holding Corp. All Rights Reserved. 18 0% 100% 200% 300% 2013 2015 2017 2019 2021 2023 In d ic e s P ri c e N o rm a li ze d OIH Index IXI Index Transforming to an Industrialized Model: Valuation Indices Comparison ✓ Improved capital discipline and industry consolidation ✓ Increasing deployment of industrial technologies and processes and emerging contracting environment ✓ Greater / improved focus on cash flow generation (FCFPS) ✓ Capacity constrained / attrition ✓ Low-growth / sustainable operating model × Excess and undisciplined capital availability and resulting overbuild × History of capital destruction under obsolete EBITDA growth model × Bias against hydrocarbons × Amplitude of industry cycles × Resulting flight of capital and investors Dislocation of OFS Stocks Reason for Multiple Rerate for OFS Stocks NOTE: OIH is the VanEck Oil Services ETF; IXI is the Industrial Select Sector Index. FCFPS is defined as free cash flow per share. OFS is a reference to Oil Field Services. Bloomberg as of February 19, 2024 OIL SERVICES INDEX (OIH) VS. INDUSTRIAL SECTOR INDEX (IXI) An industrialized model deserves valuation rerate. EXHIBIT 99.2

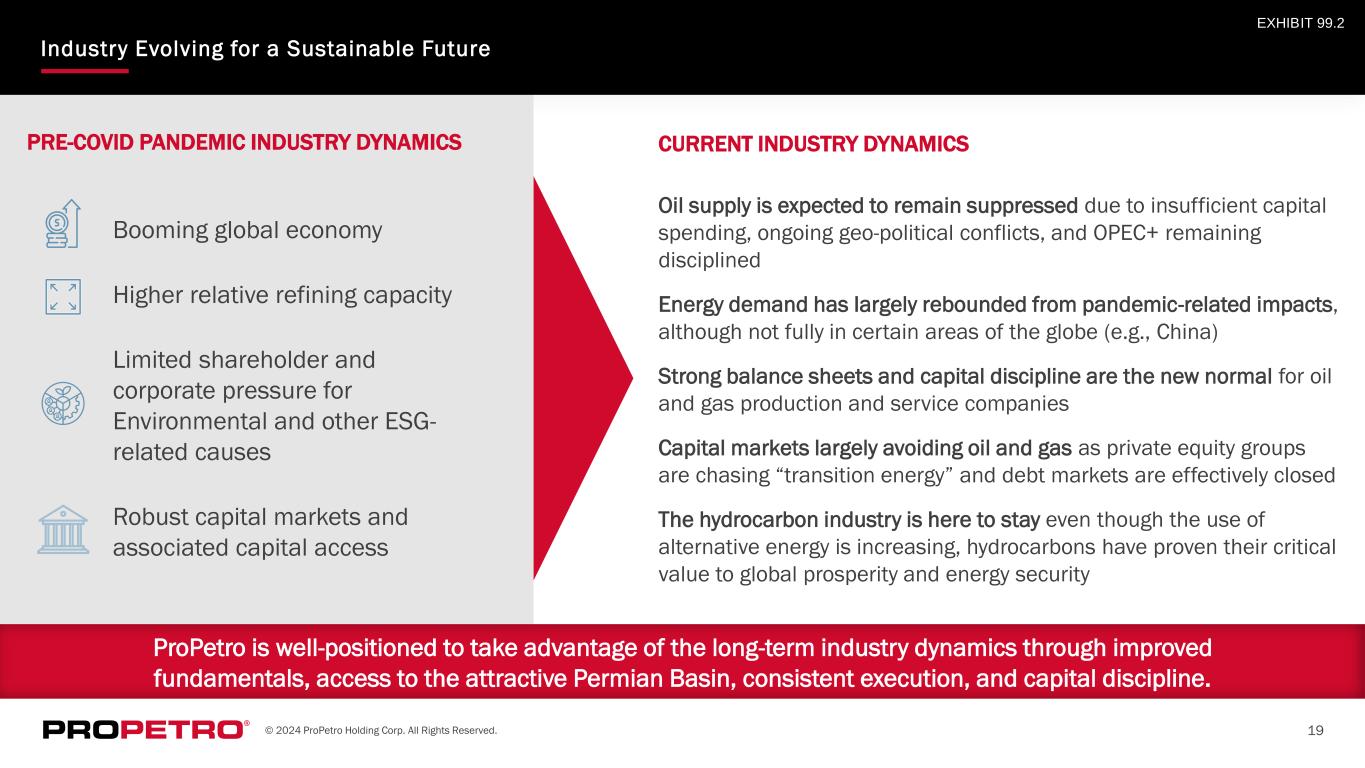

© 2024 ProPetro Holding Corp. All Rights Reserved. 19 Booming global economy Higher relative refining capacity Limited shareholder and corporate pressure for Environmental and other ESG- related causes Robust capital markets and associated capital access Industry Evolving for a Sustainable Future CURRENT INDUSTRY DYNAMICS Oil supply is expected to remain suppressed due to insufficient capital spending, ongoing geo-political conflicts, and OPEC+ remaining disciplined Energy demand has largely rebounded from pandemic-related impacts, although not fully in certain areas of the globe (e.g., China) Strong balance sheets and capital discipline are the new normal for oil and gas production and service companies Capital markets largely avoiding oil and gas as private equity groups are chasing “transition energy” and debt markets are effectively closed The hydrocarbon industry is here to stay even though the use of alternative energy is increasing, hydrocarbons have proven their critical value to global prosperity and energy security ProPetro is well-positioned to take advantage of the long-term industry dynamics through improved fundamentals, access to the attractive Permian Basin, consistent execution, and capital discipline. PRE-COVID PANDEMIC INDUSTRY DYNAMICS EXHIBIT 99.2

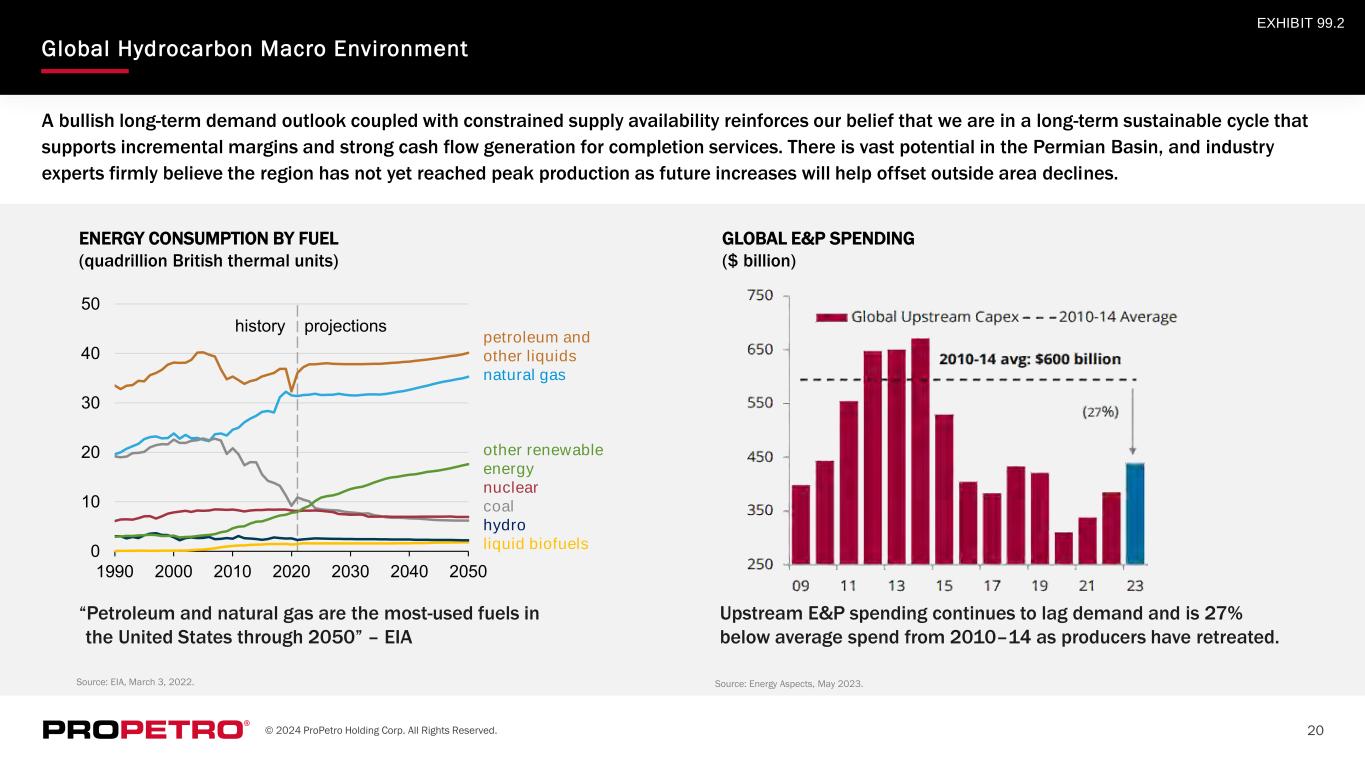

© 2024 ProPetro Holding Corp. All Rights Reserved. 20 Global Hydrocarbon Macro Environment A bullish long-term demand outlook coupled with constrained supply availability reinforces our belief that we are in a long-term sustainable cycle that supports incremental margins and strong cash flow generation for completion services. There is vast potential in the Permian Basin, and industry experts firmly believe the region has not yet reached peak production as future increases will help offset outside area declines. ENERGY CONSUMPTION BY FUEL (quadrillion British thermal units) GLOBAL E&P SPENDING ($ billion) “Petroleum and natural gas are the most-used fuels in the United States through 2050” – EIA Source: EIA, March 3, 2022. Upstream E&P spending continues to lag demand and is 27% below average spend from 2010–14 as producers have retreated. 0 10 20 30 40 50 1990 2000 2010 2020 2030 2040 2050 history projections petroleum and other liquids natural gas other renewable energy nuclear coal hydro liquid biofuels Source: Energy Aspects, May 2023. EXHIBIT 99.2

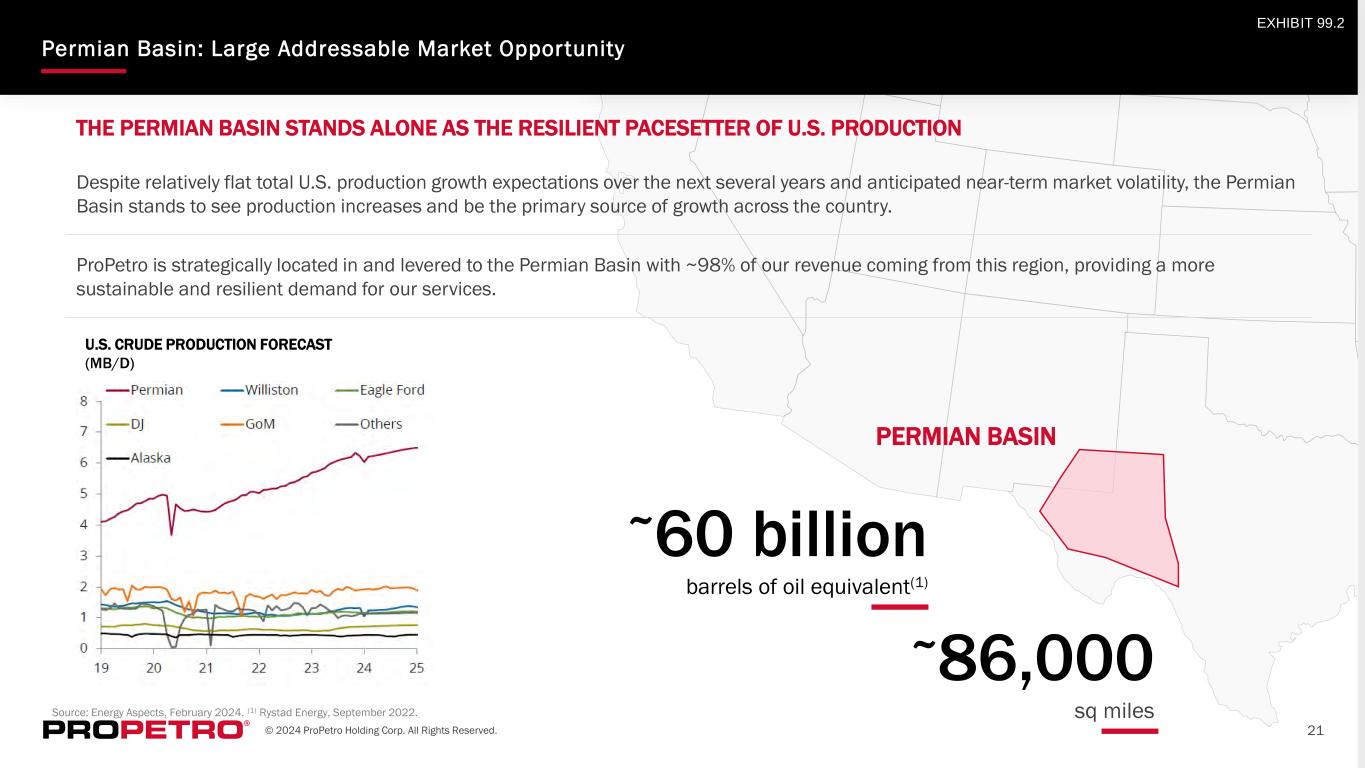

© 2024 ProPetro Holding Corp. All Rights Reserved. 21 PERMIAN BASIN ~60 billion barrels of oil equivalent(1) ~86,000 sq miles U.S. CRUDE PRODUCTION FORECAST (MB/D) THE PERMIAN BASIN STANDS ALONE AS THE RESILIENT PACESETTER OF U.S. PRODUCTION Despite relatively flat total U.S. production growth expectations over the next several years and anticipated near-term market volatility, the Permian Basin stands to see production increases and be the primary source of growth across the country. ProPetro is strategically located in and levered to the Permian Basin with ~98% of our revenue coming from this region, providing a more sustainable and resilient demand for our services. Source: Energy Aspects, February 2024. (1) Rystad Energy, September 2022. Permian Basin: Large Addressable Market Opportunity EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 22 Customer focused; Team driven Dedicated and efficient customer base harnessing the potential of the resource-rich Permian Basin Transitioning to a young, efficient, more capital-light fleet powered by natural gas and electricity Relied upon by premier customers with proven results year- after-year Disciplined capital allocation and asset deployment strategy Reducing emissions and investing in longer-lived assets Diversified customer base including the largest Permian operators Who We Are and Where We Are Going EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 23© 2024 ProPetro Holding Corp. All Rights Reserved. 23 Proven Success in the Most Challenging Environment: Unrivaled Premium Completions Services COMPLETION-RELATED SERVICES Consistent with ProPetro’s Hydraulic Fracturing, Cementing, and Wireline services HYDRAULIC FRACTURING ProPetro’s premier service line delivering industry-leading performance SPECIAL APPLICATIONS Customized treatments and complex jobs for customers that put their trust in ProPetro for reliable completions services Source: EnergyPoint Research Inc. https://www.propetroservices.com/our-services EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 24 Check out our latest ProPetro ProEnergy ProPeople Sustainability Report on our website Commitment to Our People, Our Community, and Our Environment OPTIMIZED OPERATIONS AND FLEET TRANSITION Innovation • Strategic investments in dual-fuel and electric- powered fleets, remote engineering operations, logistics, and maintenance systems Get the job done efficiently • Minimizing idle time, spills, and avoiding duplicative work Optimizing fuel consumption • Integrating cleaner-burning natural gas • Investing in Tier IV DGB dual-fuel and our FORCESM electric-powered equipment to displace diesel ENVIRONMENTAL SAFETY PEOPLE FOCUSED ON OUR TEAM • Education and tuition reimbursement to engage and advance our employees • ProPetro employees created the Positive United Morale Partners (the P.U.M.P. Committee) to drive community engagement for those in need COMMITTED TO AN ACCIDENT-FREE WORKPLACE • Strong training and development culture • Dedicated heavy haul driving team to reduce hazards on the roads in our community • Recognized with safety awards and leadership in the Permian Basin EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 25 Capital Allocation Framework: Strategy Meets Opportunity OPTIMIZE OPERATIONS Enhancing operational efficiency by focusing resources on the most relevant technologies, tools, and best practices FLEET TRANSITION With an industrializing sector, transitioning our fleet to natural gas-burning and electric offerings, which command higher demand and relative pricing DISCIPLINED GROWTH Prudently assessing value-enhancing investment opportunities to make ProPetro stronger — including opportunities to enhance scale, expand margins, and accelerate free cash flow Designed to improve free cash flow and value-distribution… …while maintaining a strong balance sheet. EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 26© 2024 ProPetro Holding Corp. All Rights Reserved. 26 Operating with a disciplined capital allocation and asset deployment strategy and optimizing our business with a strong balance sheet mitigates potential industry volatility Bifurcation in favor of ProPetro due to $1 billion in investments in 2022- 2023 in new operational technologies with financially strong and industry-leading counterparties Discounted valuation multiple relative to peers suggests a potential for normalization to the mean or beyond with the execution of a compelling business strategy Premium completion services company with one of the most efficient and productive systems in the industry focused in the prolific Permian Basin Consistently outperforms the competition – the reliable choice for the most selective customers – ProPetro is the “gold standard” and our customers value our assets and efficiencies that accelerate their production Investments in electric-powered hydraulic fracturing technology and other innovative equipment to drive industry-leading profitability and flexibility through industry cycles ProPetro’s Investment Thesis EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 27 Our Leadership: Committed to Shareholder Value Creation PHILLIP A. GOBE Chairman of the Board ANTHONY BEST Lead Independent Director, Audit Committee Chair MICHELE VION Independent Director, Compensation Committee Chair SPENCER D. ARMOUR III Independent Director JACK B. MOORE Independent Director, Nominating & Corporate Governance Committee Chair G. LARRY LAWRENCE Independent Director MARK BERG Director Board of DirectorsCompany Management ADAM MUÑOZ President and Chief Operating Officer DAVID SCHORLEMER Chief Financial Officer JODY MITCHELL General Counsel SAM SLEDGE Chief Executive Officer & Director MARY RICCIARDELLO Independent Director CELINA DAVILA Chief Accounting Officer SHELBY FIETZ Chief Commercial Officer EXHIBIT 99.2

© 2024 ProPetro Holding Corp. All Rights Reserved. 28 Investor Contacts INVESTOR RELATIONS DAVID SCHORLEMER Chief Financial Officer david.schorlemer@propetroservices.com 432.277.0864 MATT AUGUSTINE Director, Corporate Development and Investor Relations matt.augustine@propetroservices.com 432.219.7620 CORPORATE HEADQUARTERS 303 W Wall St., Suite 102 Midland, TX 79701 432.688.0012 www.propetroservices.com EXHIBIT 99.2