EX-99.1

Published on February 19, 2025

ProPetro Reports Financial Results for the Fourth Quarter and Full Year of 2024 MIDLAND, Texas, February 19, 2025, (Business Wire) – ProPetro Holding Corp. ("ProPetro" or "the Company") (NYSE: PUMP) today announced financial and operational results for the fourth quarter and full year of 2024. Full Year 2024 Results and Highlights • Revenue was $1.4 billion, an 11% decrease from 2023. • Net loss was $138 million ($1.31 loss per diluted share) as compared to net income of $86 million ($0.76 income per diluted share) in 2023. • Adjusted Net Income(1) was $29 million which excludes noncash impairment expenses. • Adjusted EBITDA(1) was $283 million, a 30% decrease from 2023. • Announced the formation of PROPWR℠, our new power generation business, with total ordered capacity of 140 megawatts of power generation equipment. • Completed the acquisition of Aqua Prop, LLC ("AquaProp℠"). • Repurchased and retired 7.2 million shares during 2024 with total repurchases of 13.0 million shares representing approximately 11% of our outstanding common stock since plan inception in May 2023. • Reduced incurred capital expenditures to $133 million, a decrease of 57% from 2023. • Net cash provided by operating activities, Free Cash Flow(2) and Free Cash Flow adjusted for Acquisition Consideration(2) were $252 million, $97 million, and $118 million, respectively. • Four FORCE® electric-powered hydraulic fracturing fleets are now operating under contract with leading customers with a fifth expected to be deployed in 2025. • Our FORCE® electric and Tier IV DGB Dual-fuel fleets now represent approximately 75% of our hydraulic fracturing capacity. • Published our second ProPetro | ProEnergy | ProPeople Sustainability Report in October of 2024. Fourth Quarter 2024 Results and Highlights • Revenue was $321 million compared to $361 million for the prior quarter. • Net loss of $17 million, or $0.17 per diluted share, compared to net loss of $137 million, or $1.32 per diluted share, for the prior quarter. • Adjusted net loss(1) was $596 thousand which excludes noncash impairment expenses. • Adjusted EBITDA(1) was $53 million compared to $71 million in the prior quarter. • Capital expenditures incurred of $25 million. • Repurchased and retired 0.4 million shares. • Placed orders for 140 megawatts of power generation equipment for our PROPWR business. • Divested Vernal, Utah, cementing operations on November 1, 2024. (1) Adjusted Net Income (Loss) and Adjusted EBITDA are non-GAAP financial measures and are described and reconciled to net income (loss) in the table under “Non-GAAP Financial Measures.” (2) Free Cash Flow and Free Cash Flow adjusted for Acquisition Consideration are non-GAAP financial measures and are described and reconciled to net cash from operating activities in the table under “Non-GAAP Financial Measures." 1 EXHIBIT 99.1

Sam Sledge, Chief Executive Officer, commented, “Thanks to the hard work and dedication of the ProPetro team, our fourth-quarter and fiscal year results reflect the merits of our strategy and the resilience of our business model. 2024 was a pivotal year for ProPetro, and our results further validate our ability to drive value despite broader industry-wide challenges. We maintained stable pricing, delivered strong free cash flow, and continued to optimize our fleet with next-generation equipment. We also successfully expanded our service offerings with the launch of PROPWR, our power generation business, opening a new avenue for growth and allowing us to meet the increasing demand for reliable, low-cost power solutions in the Permian Basin. We expect the opportunities to deliver value to our existing and new customers seeking power generation solutions to be significant. We are confident we are taking the right steps to drive long-term value creation and resilient free cash flow for shareholders.” David Schorlemer, Chief Financial Officer, said, “Despite the expected seasonal slowdown in the fourth quarter, the Company continued to demonstrate strong financial performance, maintaining free cash flow generation and a healthy balance sheet. Most noteworthy, the Company reduced its capital expenditures by nearly 60% compared to 2023. This significant achievement highlights the effectiveness of our team's optimization efforts in extending equipment life and our strategic deployment of lower capital-intensity assets, namely our FORCE® electric frac fleets. Additionally, we returned $111 million of capital through our share repurchase program since its inception in May 2023 while also improving our working capital position year-over-year. Our ability to prudently manage capital while funding strategic growth initiatives reflects our Company’s unique attributes, paired with our focus on financial and operational discipline. Thanks to the investments made over the past several years, today ProPetro is a stronger and more resilient company, poised for sustainable long-term value creation.” Fourth Quarter 2024 Financial Summary Revenue was $321 million, compared to $361 million for the third quarter of 2024. The decrease in revenue is primarily attributable to our decreased hydraulic fracturing utilization caused by seasonality and holiday impacts. Cost of services, excluding depreciation and amortization of approximately $48 million, decreased to $243 million from $268 million during the third quarter of 2024. General and administrative expense of $29 million increased from $27 million in the third quarter of 2024. General and administrative expense excluding non-recurring and non-cash stock-based compensation of $4 million, non-cash business acquisition contingent consideration adjustments of -$1 million and other non-recurring expenses of $1 million was $25 million, or 8% of revenue, compared to 6% for the third quarter of 2024. Net loss totaled $17 million, or $0.17 per diluted share, compared to net loss of $137 million, or $1.32 per diluted share, for the third quarter of 2024. The net loss for the fourth quarter included a noncash impairment expense of $24 million related to full impairment of the goodwill in our wireline reporting unit. The net loss for the prior quarter included a noncash impairment expense of $189 million related to the Company's Tier II diesel-only pumping units and related conventional equipment in our hydraulic fracturing operating segment which currently represent a diminishing part of our active fleets. Adjusted EBITDA decreased to $53 million from $71 million for the third quarter of 2024. The decrease in Adjusted EBITDA was primarily attributable to our decreased hydraulic fracturing and wireline utilization caused by seasonality and holiday impacts. Moreover, we elected to keep all fleets staffed despite the decreased utilization, in our anticipation of our customers resuming operations in early January 2025. Liquidity and Capital Spending 2 EXHIBIT 99.1

As of December 31, 2024, we had cash and cash equivalents of $50 million and borrowings under our ABL Credit Facility were $45 million. Total liquidity at the end of the fourth quarter of 2024 was $161 million, which included cash and cash equivalents and $111 million of available borrowing capacity under our ABL Credit Facility. Capital expenditures incurred during the fourth quarter of 2024 were $25 million, the majority of which related to maintenance expenditures and support equipment for our FORCE® electric frac fleet offering. Net cash used in investing activities as shown on the statement of cash flows during the fourth quarter of 2024 was $24 million. Share Repurchases The Company repurchased and retired 7.2 million shares during 2024. During the fourth quarter of 2024, the Company repurchased and retired 0.4 million shares, bringing the total repurchases to 13.0 million shares, representing approximately 11% of our outstanding common stock since plan inception in May 2023. PROPWR Update In December, we announced an initial order for over 110 megawatts of natural gas-fueled power generation equipment, valued at $122 million. Approximately $104 million of this amount, beyond the initial down payment, will be financed. Subsequently, we entered into a separate agreement with another equipment manufacturer to purchase an additional 30 megawatts of power generation equipment, valued at $25 million, which will be funded through our cash flow. We plan to place further orders for additional power generation capacity in the coming weeks and months as we finalize customer contracts and assess future demand from our customers. The majority of these deliveries are anticipated in the second half of 2025 and early 2026, bringing our total capacity to between approximately 150 and 200 megawatts in early 2026. We aim to continue expanding this business line over the next several years, given favorable market conditions and demand trends. We have made progress in obtaining customer commitments and are actively negotiating long-term contracts for our incoming equipment. Guidance The Company anticipates full-year 2025 capital expenditures to be between $300 million and $400 million. Of this, the completions business is expected to account for $150 million to $200 million, while an additional $150 million to $200 million will be allocated for growth capital expenditures in our PROPWR business. The Company expects to finance a significant portion of the PROPWR capital expenditures. During the fourth quarter of 2024, 14 hydraulic fracturing fleets were active but experienced white space due to holiday and seasonality impacts. The Company expects to run between 14 and 15 frac fleets in the first quarter of 2025. Outlook Mr. Sledge concluded, “Looking ahead, we are excited about the opportunities in front of us and enter 2025 with great momentum, a strong foundation, and a clear vision for the future. Our fleet modernization efforts will continue to drive efficiencies for our customers while enhancing our competitive positioning. At the same time, the introduction of PROPWR represents an exciting avenue for growth, positioning ProPetro to capitalize on the supply demand imbalance for natural gas power generation solutions across a number of verticals in the energy industry and beyond. With a strong balance sheet, disciplined capital 3 EXHIBIT 99.1

allocation program, and unwavering focus on operational excellence, we believe 2025 will be another positive year for ProPetro.” Conference Call Information The Company will host a conference call at 8:00 AM Central Time on February 19, 2025, to discuss financial and operating results for the fourth quarter of 2024. The call will also be webcast on ProPetro’s website at www.propetroservices.com. To access the conference call, U.S. callers may dial toll free 1-844-340-9046 and international callers may dial 1-412-858-5205. Please call ten minutes ahead of the scheduled start time to ensure a proper connection. A replay of the conference call will be available for one week following the call and can be accessed toll free by dialing 1-877-344-7529 for U.S. callers, 1-855-669-9658 for Canadian callers, as well as 1-412-317-0088 for international callers. The access code for the replay is 4912422. The Company has also posted the scripted remarks on its website. About ProPetro ProPetro Holding Corp. is a Midland, Texas-based provider of premium completion services to leading upstream oil and gas companies engaged in the exploration and production of North American unconventional oil and natural gas resources. We help bring reliable energy to the world. For more information visit www.propetroservices.com. Forward-Looking Statements Except for historical information contained herein, the statements and information in this news release and discussion in the scripted remarks described above are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “may,” “could,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” "will," "should" and other expressions that are predictions of, or indicate, future events and trends or that do not relate to historical matters generally identify forward-looking statements. Our forward-looking statements include, among other matters, statements about the supply of and demand for hydrocarbons, our business strategy, industry, projected financial results and future financial performance, expected fleet utilization, sustainability efforts, the future performance of newly improved technology, expected capital expenditures, the impact of such expenditures on our performance and capital programs, our fleet conversion strategy, our share repurchase program, and the anticipated commercial prospects of PROPWR, including our ability to successfully commence operations, the demand for its services and anticipated benefits of the new business line. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. Although forward-looking statements reflect our good faith beliefs at the time they are made, forward- looking statements are subject to a number of risks and uncertainties that may cause actual events and results to differ materially from the forward-looking statements. Such risks and uncertainties include the volatility of oil prices, changes in the supply of and demand for power generation, the risks associated with the establishment of a new service line, including delays, lack of customer acceptance and cost overruns, the global macroeconomic uncertainty related to the conflict in the Middle East region and the Russia-Ukraine war, general economic conditions, including the impact of continued inflation, central bank 4 EXHIBIT 99.1

policy actions, the risk of a global recession, changes in U.S. trade policy, including proposed tariffs, and other factors described in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, particularly the “Risk Factors” sections of such filings, and other filings with the Securities and Exchange Commission (the “SEC”). In addition, the Company may be subject to currently unforeseen risks that may have a materially adverse impact on it. Accordingly, no assurances can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements and are urged to carefully review and consider the various disclosures made in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings made with the SEC from time to time that disclose risks and uncertainties that may affect the Company’s business. The forward-looking statements in this news release are made as of the date of this news release. ProPetro does not undertake, and expressly disclaims, any duty to publicly update these statements, whether as a result of new information, new developments or otherwise, except to the extent that disclosure is required by law. Investor Contacts: David Schorlemer Chief Financial Officer david.schorlemer@propetroservices.com 432-227-0864 Matt Augustine Director, Corporate Development and Investor Relations matt.augustine@propetroservices.com 432-219-7620 5 EXHIBIT 99.1

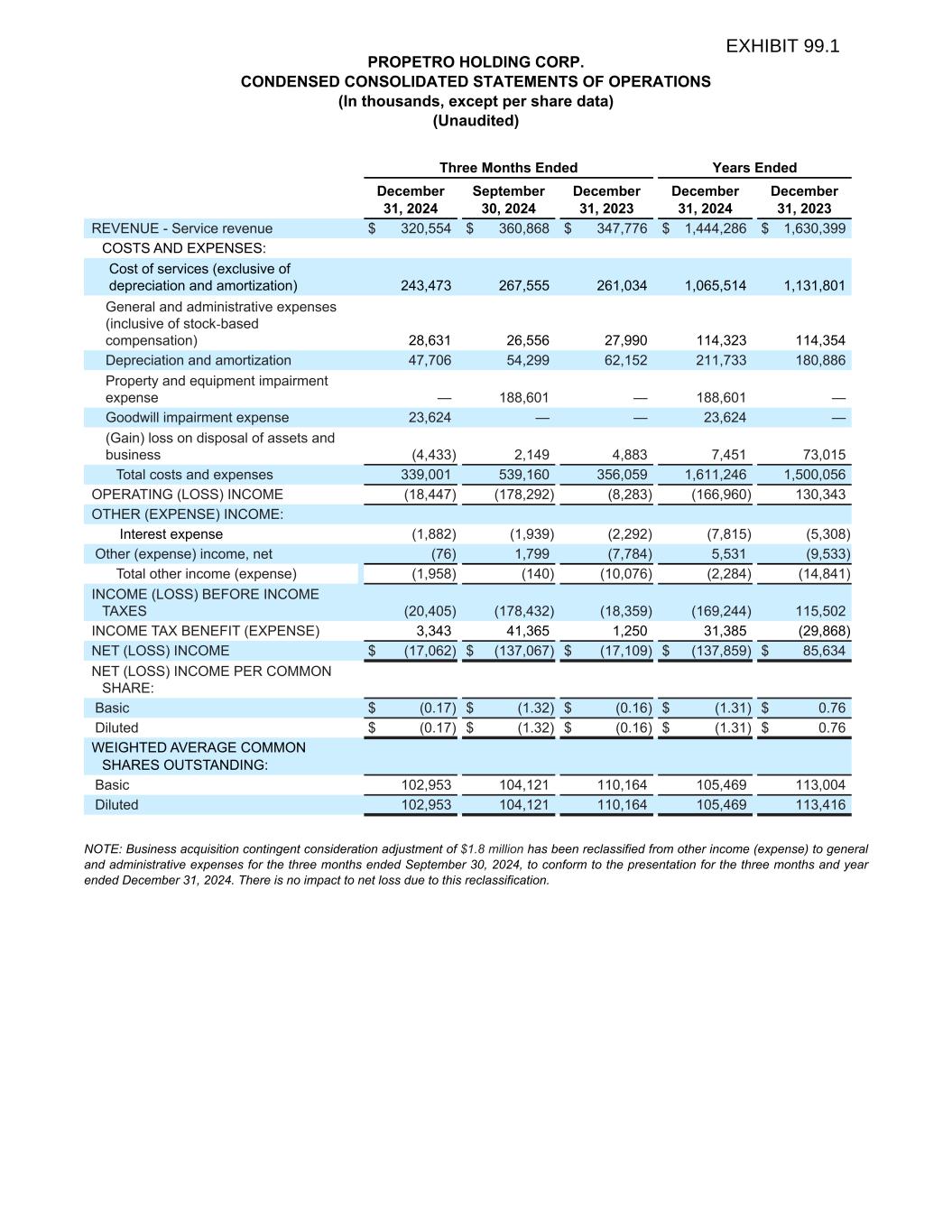

PROPETRO HOLDING CORP. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) (Unaudited) Three Months Ended Years Ended December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 December 31, 2023 REVENUE - Service revenue $ 320,554 $ 360,868 $ 347,776 $ 1,444,286 $ 1,630,399 COSTS AND EXPENSES: Cost of services (exclusive of depreciation and amortization) 243,473 267,555 261,034 1,065,514 1,131,801 General and administrative expenses (inclusive of stock-based compensation) 28,631 26,556 27,990 114,323 114,354 Depreciation and amortization 47,706 54,299 62,152 211,733 180,886 Property and equipment impairment expense — 188,601 — 188,601 — Goodwill impairment expense 23,624 — — 23,624 — (Gain) loss on disposal of assets and business (4,433) 2,149 4,883 7,451 73,015 Total costs and expenses 339,001 539,160 356,059 1,611,246 1,500,056 OPERATING (LOSS) INCOME (18,447) (178,292) (8,283) (166,960) 130,343 OTHER (EXPENSE) INCOME: Interest expense (1,882) (1,939) (2,292) (7,815) (5,308) Other (expense) income, net (76) 1,799 (7,784) 5,531 (9,533) Total other income (expense) (1,958) (140) (10,076) (2,284) (14,841) INCOME (LOSS) BEFORE INCOME TAXES (20,405) (178,432) (18,359) (169,244) 115,502 INCOME TAX BENEFIT (EXPENSE) 3,343 41,365 1,250 31,385 (29,868) NET (LOSS) INCOME $ (17,062) $ (137,067) $ (17,109) $ (137,859) $ 85,634 NET (LOSS) INCOME PER COMMON SHARE: Basic $ (0.17) $ (1.32) $ (0.16) $ (1.31) $ 0.76 Diluted $ (0.17) $ (1.32) $ (0.16) $ (1.31) $ 0.76 WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: Basic 102,953 104,121 110,164 105,469 113,004 Diluted 102,953 104,121 110,164 105,469 113,416 NOTE: Business acquisition contingent consideration adjustment of $1.8 million has been reclassified from other income (expense) to general and administrative expenses for the three months ended September 30, 2024, to conform to the presentation for the three months and year ended December 31, 2024. There is no impact to net loss due to this reclassification. EXHIBIT 99.1

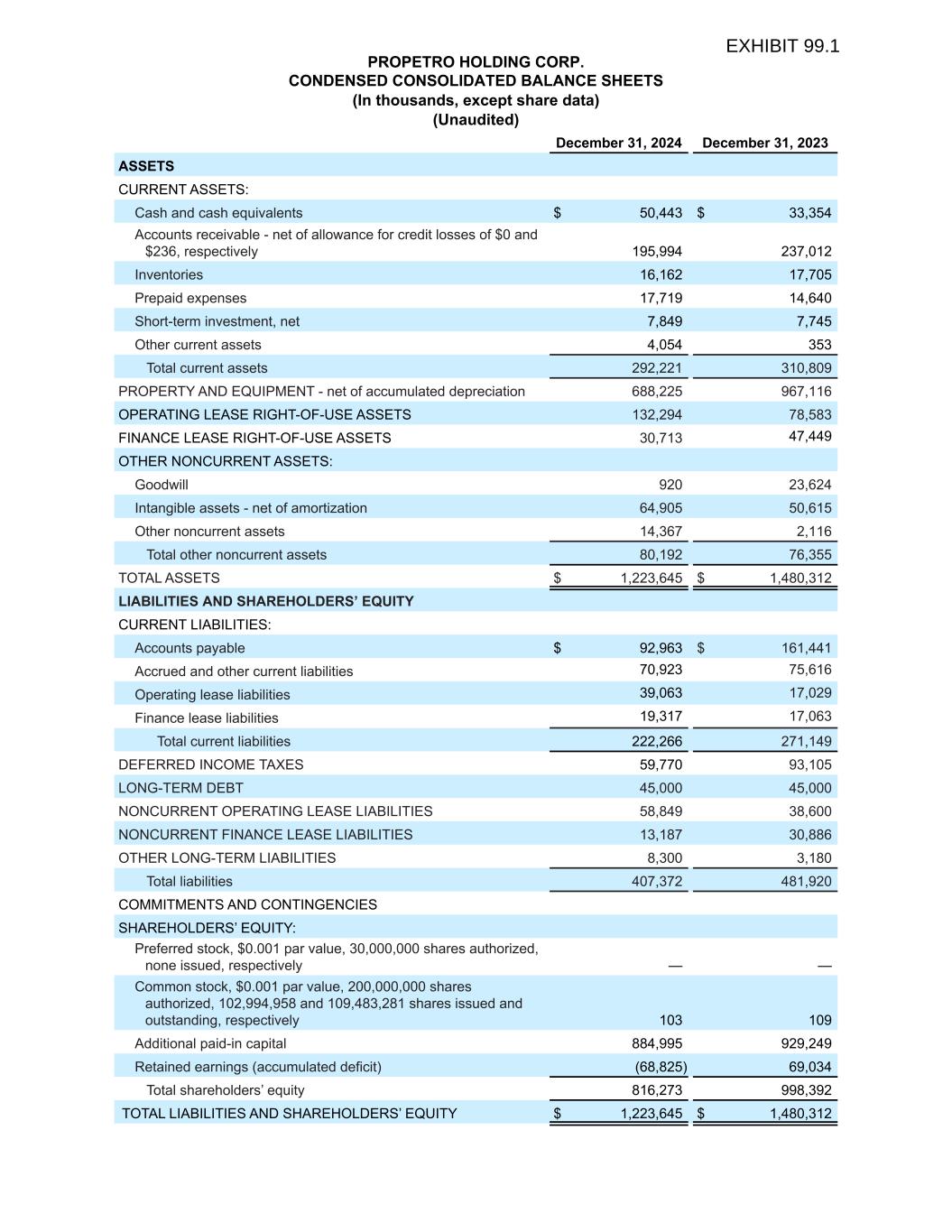

PROPETRO HOLDING CORP. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except share data) (Unaudited) December 31, 2024 December 31, 2023 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 50,443 $ 33,354 Accounts receivable - net of allowance for credit losses of $0 and $236, respectively 195,994 237,012 Inventories 16,162 17,705 Prepaid expenses 17,719 14,640 Short-term investment, net 7,849 7,745 Other current assets 4,054 353 Total current assets 292,221 310,809 PROPERTY AND EQUIPMENT - net of accumulated depreciation 688,225 967,116 OPERATING LEASE RIGHT-OF-USE ASSETS 132,294 78,583 FINANCE LEASE RIGHT-OF-USE ASSETS 30,713 47,449 OTHER NONCURRENT ASSETS: Goodwill 920 23,624 Intangible assets - net of amortization 64,905 50,615 Other noncurrent assets 14,367 2,116 Total other noncurrent assets 80,192 76,355 TOTAL ASSETS $ 1,223,645 $ 1,480,312 LIABILITIES AND SHAREHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $ 92,963 $ 161,441 Accrued and other current liabilities 70,923 75,616 Operating lease liabilities 39,063 17,029 Finance lease liabilities 19,317 17,063 Total current liabilities 222,266 271,149 DEFERRED INCOME TAXES 59,770 93,105 LONG-TERM DEBT 45,000 45,000 NONCURRENT OPERATING LEASE LIABILITIES 58,849 38,600 NONCURRENT FINANCE LEASE LIABILITIES 13,187 30,886 OTHER LONG-TERM LIABILITIES 8,300 3,180 Total liabilities 407,372 481,920 COMMITMENTS AND CONTINGENCIES SHAREHOLDERS’ EQUITY: Preferred stock, $0.001 par value, 30,000,000 shares authorized, none issued, respectively — — Common stock, $0.001 par value, 200,000,000 shares authorized, 102,994,958 and 109,483,281 shares issued and outstanding, respectively 103 109 Additional paid-in capital 884,995 929,249 Retained earnings (accumulated deficit) (68,825) 69,034 Total shareholders’ equity 816,273 998,392 TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $ 1,223,645 $ 1,480,312 EXHIBIT 99.1

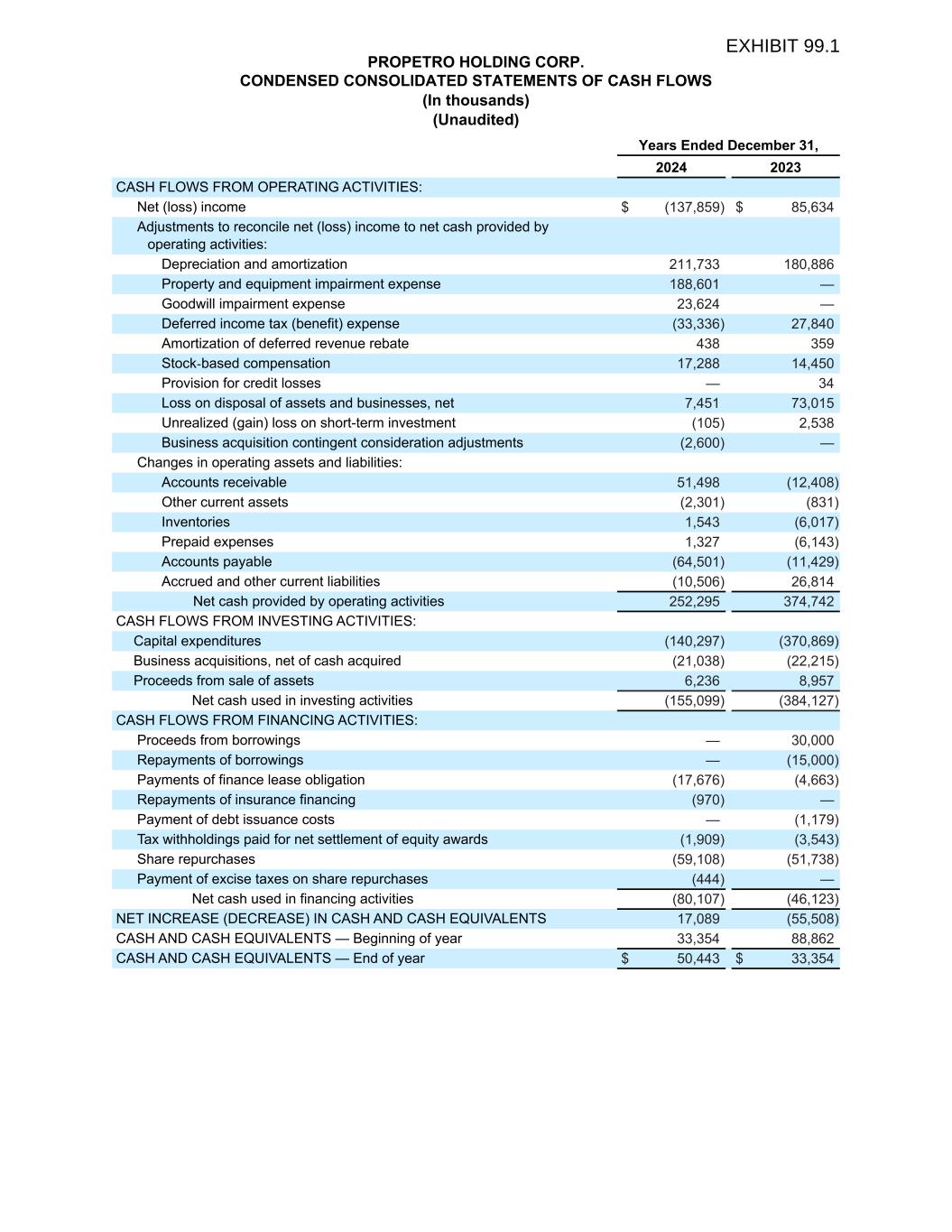

PROPETRO HOLDING CORP. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) Years Ended December 31, 2024 2023 CASH FLOWS FROM OPERATING ACTIVITIES: Net (loss) income $ (137,859) $ 85,634 Adjustments to reconcile net (loss) income to net cash provided by operating activities: Depreciation and amortization 211,733 180,886 Property and equipment impairment expense 188,601 — Goodwill impairment expense 23,624 — Deferred income tax (benefit) expense (33,336) 27,840 Amortization of deferred revenue rebate 438 359 Stock-based compensation 17,288 14,450 Provision for credit losses — 34 Loss on disposal of assets and businesses, net 7,451 73,015 Unrealized (gain) loss on short-term investment (105) 2,538 Business acquisition contingent consideration adjustments (2,600) — Changes in operating assets and liabilities: Accounts receivable 51,498 (12,408) Other current assets (2,301) (831) Inventories 1,543 (6,017) Prepaid expenses 1,327 (6,143) Accounts payable (64,501) (11,429) Accrued and other current liabilities (10,506) 26,814 Net cash provided by operating activities 252,295 374,742 CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (140,297) (370,869) Business acquisitions, net of cash acquired (21,038) (22,215) Proceeds from sale of assets 6,236 8,957 Net cash used in investing activities (155,099) (384,127) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from borrowings — 30,000 Repayments of borrowings — (15,000) Payments of finance lease obligation (17,676) (4,663) Repayments of insurance financing (970) — Payment of debt issuance costs — (1,179) Tax withholdings paid for net settlement of equity awards (1,909) (3,543) Share repurchases (59,108) (51,738) Payment of excise taxes on share repurchases (444) — Net cash used in financing activities (80,107) (46,123) NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 17,089 (55,508) CASH AND CASH EQUIVALENTS — Beginning of year 33,354 88,862 CASH AND CASH EQUIVALENTS — End of year $ 50,443 $ 33,354 EXHIBIT 99.1

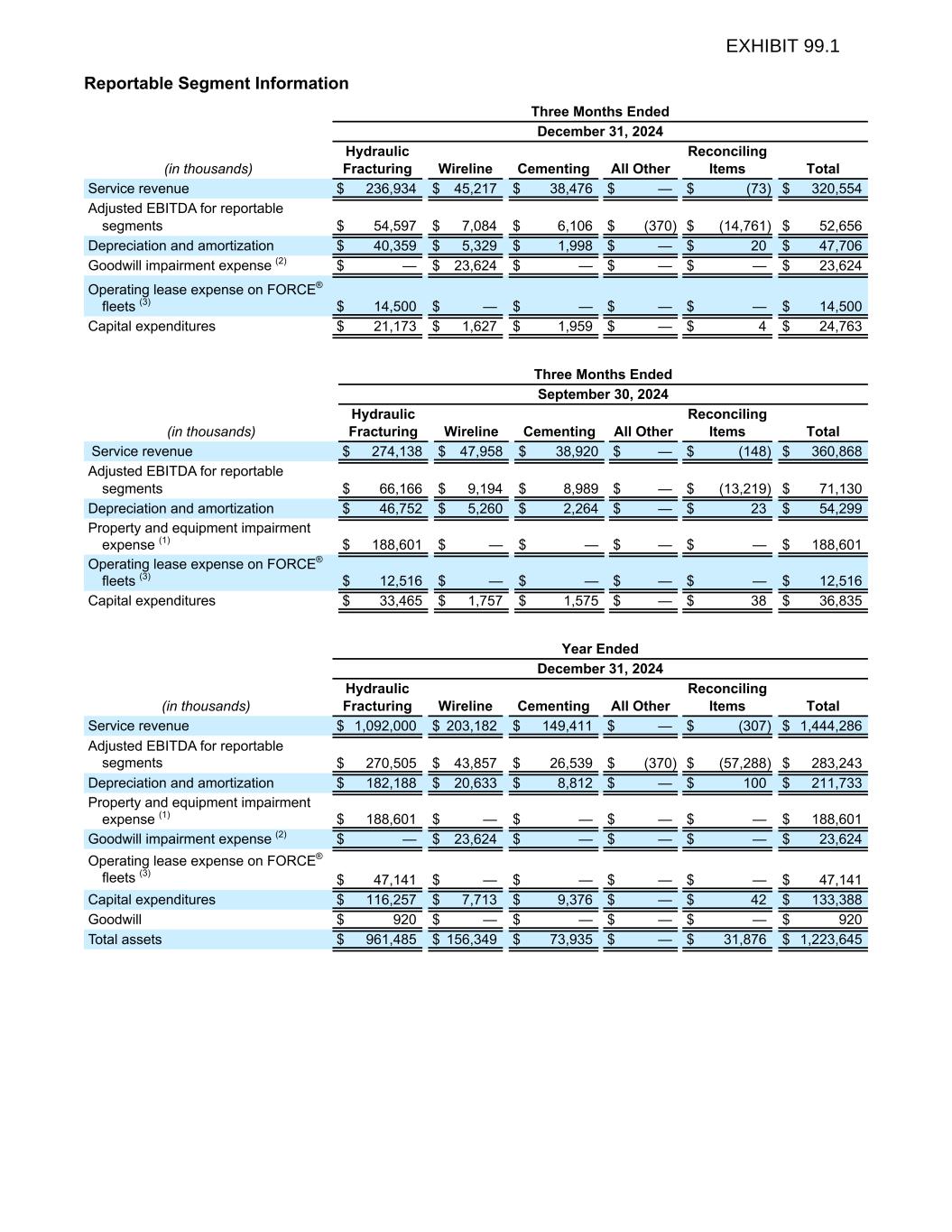

Reportable Segment Information Three Months Ended December 31, 2024 (in thousands) Hydraulic Fracturing Wireline Cementing All Other Reconciling Items Total Service revenue $ 236,934 $ 45,217 $ 38,476 $ — $ (73) $ 320,554 Adjusted EBITDA for reportable segments $ 54,597 $ 7,084 $ 6,106 $ (370) $ (14,761) $ 52,656 Depreciation and amortization $ 40,359 $ 5,329 $ 1,998 $ — $ 20 $ 47,706 Goodwill impairment expense (2) $ — $ 23,624 $ — $ — $ — $ 23,624 Operating lease expense on FORCE® fleets (3) $ 14,500 $ — $ — $ — $ — $ 14,500 Capital expenditures $ 21,173 $ 1,627 $ 1,959 $ — $ 4 $ 24,763 Three Months Ended September 30, 2024 (in thousands) Hydraulic Fracturing Wireline Cementing All Other Reconciling Items Total Service revenue $ 274,138 $ 47,958 $ 38,920 $ — $ (148) $ 360,868 Adjusted EBITDA for reportable segments $ 66,166 $ 9,194 $ 8,989 $ — $ (13,219) $ 71,130 Depreciation and amortization $ 46,752 $ 5,260 $ 2,264 $ — $ 23 $ 54,299 Property and equipment impairment expense (1) $ 188,601 $ — $ — $ — $ — $ 188,601 Operating lease expense on FORCE® fleets (3) $ 12,516 $ — $ — $ — $ — $ 12,516 Capital expenditures $ 33,465 $ 1,757 $ 1,575 $ — $ 38 $ 36,835 Year Ended December 31, 2024 (in thousands) Hydraulic Fracturing Wireline Cementing All Other Reconciling Items Total Service revenue $ 1,092,000 $ 203,182 $ 149,411 $ — $ (307) $ 1,444,286 Adjusted EBITDA for reportable segments $ 270,505 $ 43,857 $ 26,539 $ (370) $ (57,288) $ 283,243 Depreciation and amortization $ 182,188 $ 20,633 $ 8,812 $ — $ 100 $ 211,733 Property and equipment impairment expense (1) $ 188,601 $ — $ — $ — $ — $ 188,601 Goodwill impairment expense (2) $ — $ 23,624 $ — $ — $ — $ 23,624 Operating lease expense on FORCE® fleets (3) $ 47,141 $ — $ — $ — $ — $ 47,141 Capital expenditures $ 116,257 $ 7,713 $ 9,376 $ — $ 42 $ 133,388 Goodwill $ 920 $ — $ — $ — $ — $ 920 Total assets $ 961,485 $ 156,349 $ 73,935 $ — $ 31,876 $ 1,223,645 EXHIBIT 99.1

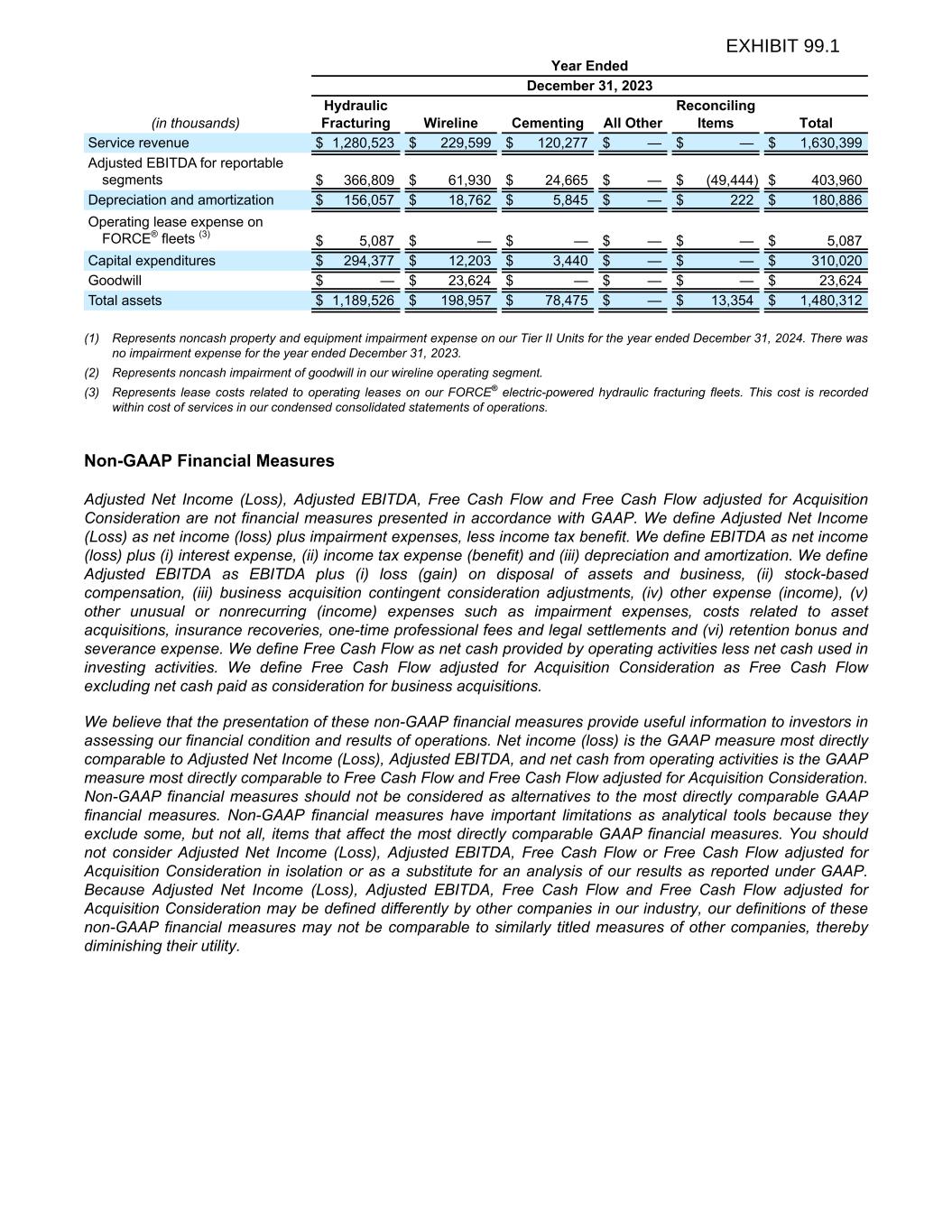

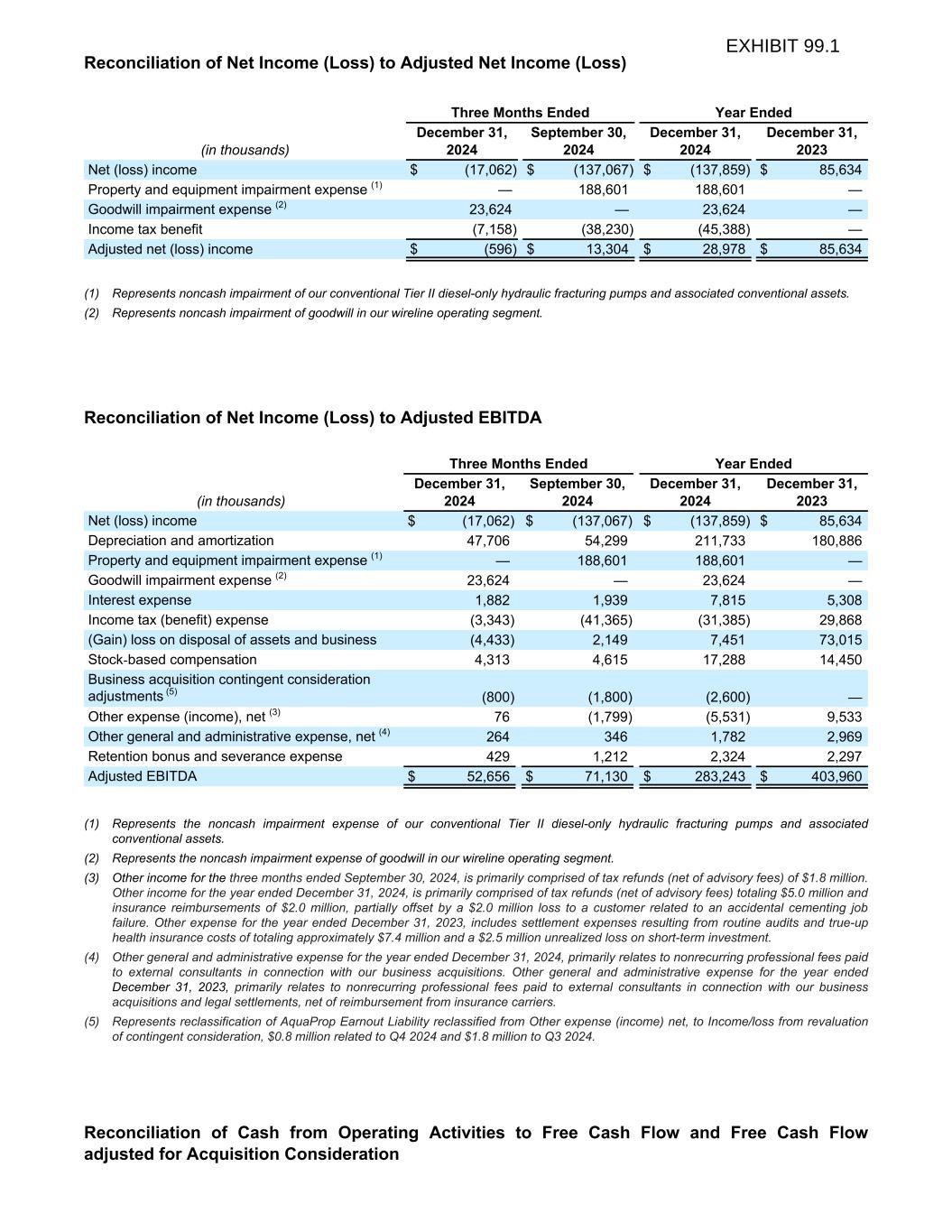

Year Ended December 31, 2023 (in thousands) Hydraulic Fracturing Wireline Cementing All Other Reconciling Items Total Service revenue $ 1,280,523 $ 229,599 $ 120,277 $ — $ — $ 1,630,399 Adjusted EBITDA for reportable segments $ 366,809 $ 61,930 $ 24,665 $ — $ (49,444) $ 403,960 Depreciation and amortization $ 156,057 $ 18,762 $ 5,845 $ — $ 222 $ 180,886 Operating lease expense on FORCE® fleets (3) $ 5,087 $ — $ — $ — $ — $ 5,087 Capital expenditures $ 294,377 $ 12,203 $ 3,440 $ — $ — $ 310,020 Goodwill $ — $ 23,624 $ — $ — $ — $ 23,624 Total assets $ 1,189,526 $ 198,957 $ 78,475 $ — $ 13,354 $ 1,480,312 (1) Represents noncash property and equipment impairment expense on our Tier II Units for the year ended December 31, 2024. There was no impairment expense for the year ended December 31, 2023. (2) Represents noncash impairment of goodwill in our wireline operating segment. (3) Represents lease costs related to operating leases on our FORCE® electric-powered hydraulic fracturing fleets. This cost is recorded within cost of services in our condensed consolidated statements of operations. Non-GAAP Financial Measures Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash Flow and Free Cash Flow adjusted for Acquisition Consideration are not financial measures presented in accordance with GAAP. We define Adjusted Net Income (Loss) as net income (loss) plus impairment expenses, less income tax benefit. We define EBITDA as net income (loss) plus (i) interest expense, (ii) income tax expense (benefit) and (iii) depreciation and amortization. We define Adjusted EBITDA as EBITDA plus (i) loss (gain) on disposal of assets and business, (ii) stock-based compensation, (iii) business acquisition contingent consideration adjustments, (iv) other expense (income), (v) other unusual or nonrecurring (income) expenses such as impairment expenses, costs related to asset acquisitions, insurance recoveries, one-time professional fees and legal settlements and (vi) retention bonus and severance expense. We define Free Cash Flow as net cash provided by operating activities less net cash used in investing activities. We define Free Cash Flow adjusted for Acquisition Consideration as Free Cash Flow excluding net cash paid as consideration for business acquisitions. We believe that the presentation of these non-GAAP financial measures provide useful information to investors in assessing our financial condition and results of operations. Net income (loss) is the GAAP measure most directly comparable to Adjusted Net Income (Loss), Adjusted EBITDA, and net cash from operating activities is the GAAP measure most directly comparable to Free Cash Flow and Free Cash Flow adjusted for Acquisition Consideration. Non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measures. Non-GAAP financial measures have important limitations as analytical tools because they exclude some, but not all, items that affect the most directly comparable GAAP financial measures. You should not consider Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash Flow or Free Cash Flow adjusted for Acquisition Consideration in isolation or as a substitute for an analysis of our results as reported under GAAP. Because Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash Flow and Free Cash Flow adjusted for Acquisition Consideration may be defined differently by other companies in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. EXHIBIT 99.1

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) Three Months Ended Year Ended (in thousands) December 31, 2024 September 30, 2024 December 31, 2024 December 31, 2023 Net (loss) income $ (17,062) $ (137,067) $ (137,859) $ 85,634 Property and equipment impairment expense (1) — 188,601 188,601 — Goodwill impairment expense (2) 23,624 — 23,624 — Income tax benefit (7,158) (38,230) (45,388) — Adjusted net (loss) income $ (596) $ 13,304 $ 28,978 $ 85,634 (1) Represents noncash impairment of our conventional Tier II diesel-only hydraulic fracturing pumps and associated conventional assets. (2) Represents noncash impairment of goodwill in our wireline operating segment. Reconciliation of Net Income (Loss) to Adjusted EBITDA Three Months Ended Year Ended (in thousands) December 31, 2024 September 30, 2024 December 31, 2024 December 31, 2023 Net (loss) income $ (17,062) $ (137,067) $ (137,859) $ 85,634 Depreciation and amortization 47,706 54,299 211,733 180,886 Property and equipment impairment expense (1) — 188,601 188,601 — Goodwill impairment expense (2) 23,624 — 23,624 — Interest expense 1,882 1,939 7,815 5,308 Income tax (benefit) expense (3,343) (41,365) (31,385) 29,868 (Gain) loss on disposal of assets and business (4,433) 2,149 7,451 73,015 Stock-based compensation 4,313 4,615 17,288 14,450 Business acquisition contingent consideration adjustments (5) (800) (1,800) (2,600) — Other expense (income), net (3) 76 (1,799) (5,531) 9,533 Other general and administrative expense, net (4) 264 346 1,782 2,969 Retention bonus and severance expense 429 1,212 2,324 2,297 Adjusted EBITDA $ 52,656 $ 71,130 $ 283,243 $ 403,960 (1) Represents the noncash impairment expense of our conventional Tier II diesel-only hydraulic fracturing pumps and associated conventional assets. (2) Represents the noncash impairment expense of goodwill in our wireline operating segment. (3) Other income for the three months ended September 30, 2024, is primarily comprised of tax refunds (net of advisory fees) of $1.8 million. Other income for the year ended December 31, 2024, is primarily comprised of tax refunds (net of advisory fees) totaling $5.0 million and insurance reimbursements of $2.0 million, partially offset by a $2.0 million loss to a customer related to an accidental cementing job failure. Other expense for the year ended December 31, 2023, includes settlement expenses resulting from routine audits and true-up health insurance costs of totaling approximately $7.4 million and a $2.5 million unrealized loss on short-term investment. (4) Other general and administrative expense for the year ended December 31, 2024, primarily relates to nonrecurring professional fees paid to external consultants in connection with our business acquisitions. Other general and administrative expense for the year ended December 31, 2023, primarily relates to nonrecurring professional fees paid to external consultants in connection with our business acquisitions and legal settlements, net of reimbursement from insurance carriers. (5) Represents reclassification of AquaProp Earnout Liability reclassified from Other expense (income) net, to Income/loss from revaluation of contingent consideration, $0.8 million related to Q4 2024 and $1.8 million to Q3 2024. Reconciliation of Cash from Operating Activities to Free Cash Flow and Free Cash Flow adjusted for Acquisition Consideration EXHIBIT 99.1

Three Months Ended (in thousands) December 31, 2024 September 30, 2024 Cash from Operating Activities $ 37,863 $ 34,669 Cash used in Investing Activities (24,496) (39,680) Free Cash Flow 13,367 (5,011) Acquisition Consideration — — Free Cash Flow adjusted for Acquisition Consideration $ 13,367 $ (5,011) Year Ended (in thousands) December 31, 2024 December 31, 2023 Cash from Operating Activities $ 252,295 $ 374,742 Cash used in Investing Activities (155,099) (384,127) Free Cash Flow 97,196 (9,385) Acquisition Consideration 21,038 22,215 Free Cash Flow adjusted for Acquisition Consideration $ 118,234 $ 12,830 EXHIBIT 99.1